For a long time traditional banks enjoyed headship in the financial sector across the globe. Now, with the rise of financial technology, banks have to compete with a rising number of FinTech companies that provide products and services in the niche areas of banking.

Indeed, most of the requests for FinTech product development we at MindK receive from our clients are focused on solving the pain points traditional banks cannot solve and providing financial services in an easier and more convenient way.

To put things in perspective, we’ve already investigated the key factors that fuel the growth of the FinTech market. All indicates that the FinTech sector is likely to keep on gaining strength. Its combined annual growth rate is expected to grow up to 23.41%, leading the market to reach $324 billion in the nearest 5 years.

In view of this, it becomes very important to understand how FinTech is changing banking and whether FinTech is able to displace banking at all. Let’s puzzle it out!

FinTech impact on the banking industry: friends or foes?

Traditional banking has good reason to identify FinTech as a threat to its competitiveness and relevance. FinTech solutions for banks keep on providing more innovative products and cheaper, quality services for users compared to traditional banks, and makes people wonder whether FinTech will replace traditional banks in the near future?

In this situation, banks have two possible scenarios – let FinTech companies win over, or improve their services to retain their customers. The rising number of banks that invest in technology shows they do not want to lose.

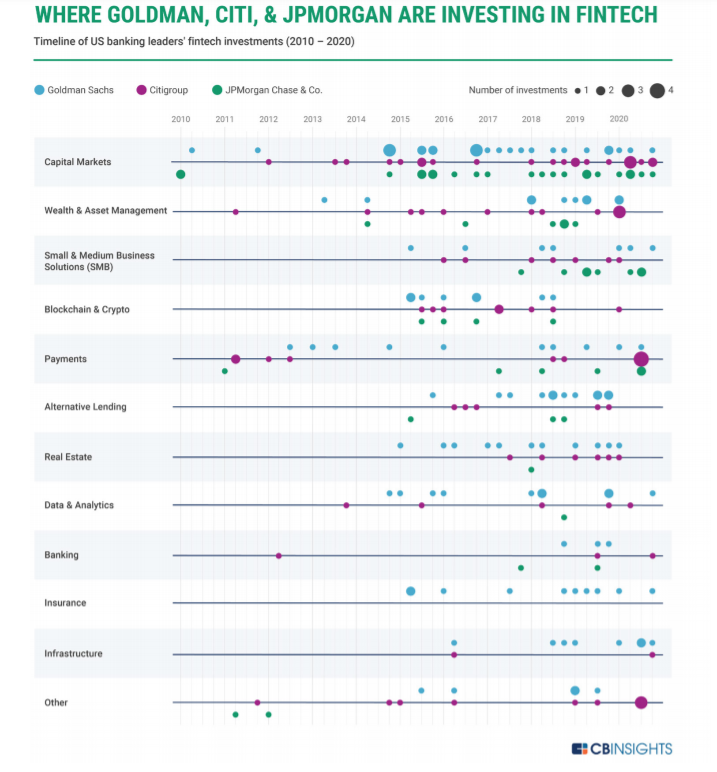

Moreover, it seems like over the last few years, traditional banks are trying to turn a threat into an opportunity and partner with FinTech companies. For example, according to the recent CBInsignt report, US banks made equity investments into more than 65 FinTech companies in 2020.

Among the most active bank investors by number of deals are Goldman Sachs, Citigroup, and JPMorgan Chase & Co. In 2020 they mostly invested in such FinTech areas as capital markets, wealth & asset management, and payments.

The report also highlights that the major drivers for bank investments in FinTech are potential for high returns and strategic partnerships. For example, after JPMorgan participated in a $60M strategic funding round for FinTech company Taulia last year, they announced a partnership to create a trade finance solution for corporate clients.

To sum up, it is very unlikely that FinTech companies will replace traditional banks in the near future. Banks have more trust from people in terms of holding money, while FinTech companies need time to gain such credibility.

It seems that both financial technology and banking are benefiting by coming together rather than competing. Such collaborations give banks innovative technology partners. Fintech companies, on the other hand, receive a large stable client base, a stamp of trust that confirms the credibility, flow of capital to develop services, and internal knowledge in areas that FinTech firms can benefit from like legal and regulatory compliance and risk management.

Now that we see Fintech companies and traditional banks are friends, not foes, let’s review: How does FinTech affect banks? And how will FinTech change the future of banking?

There’s progress: сhanges in banking services inspired by the FinTech revolution

FinTech makes banking more timesaving

Time is crucial for any type of business, especially if it involves monetary operations. While most FinTech companies work online under the motto “no more queues”, traditional banks are still obsessive about person-to-person service delivery.

In the current business environment strongly affected by the COVID-19 pandemic, FinTech banking solutions suggest a more convenient way of doing business. Instead of spending time visiting a bank, people can complete all required financial transactions from their smartphone or laptop.

According to the recent Digital Banking Attitudes Study by Chase, the majority of people, namely 4 in 5 customers, prefer managing finances online rather than in person. Almost 89% of Chase clients feel that managing their finances digitally significantly saves their time.

Indeed, thanks to advanced technologies like artificial intelligence, machine learning, and automated processes, clients can solve problems much faster. For example, you can open an account within a day or two, without waiting two weeks or a month, or choose financial products like pension savings and mortgages much faster compared to traditional banks.

One of our clients, a Norwegian consulting company, managed to turn a complex pension and insurance calculation process into a few-clicks task. MindK developed a platform that automatically calculates retirement plans and insurance packages online without the need to go to the office.

To meet the growing need of customers to get banking services online at lightning speed, banks keep on investing in digitization and automation of business processes.

Almost half of banks (44%) and a quarter of credit unions are planning to add a new or improve the existing consumer digital account opening system in 2021. It’s not a surprise because digital account opening and onboarding experience are considered one of the biggest pain points that restrain less time-consuming banking services.

FinTech makes banking mobile

Mobile banking has been treated lightly for a long time by bank institutions. In our previous article about how to create a mobile banking app, we discussed that mobile banking solutions have turned from a long-ignored tool into a game-changing advantage for the banking business.

There are several reasons for that. The first is because traditional banks have been inspired by the success of FinTech startups in the mobile banking area, namely a growing number of mobile-only banks (or neobanks) like Monzo (UK), Starling Bank (UK), Simple (USA), Fidor Bank (USA, Europe, Asia), N26 (Europe), Revolut and so forth.

Second, the pandemic significantly increased the use of mobile apps. Last year there was a 200% increase in new mobile banking registrations, and an 85% rise in mobile banking traffic. Now, in 2021 mobile banking adoption is still increasing.

According to Cornerstone Advisors’ study, mobile banking usage grows throughout all generations. Compared to 2020, it has increased to 95% among Gen Z, up to 91% among the Millennials, up to 85% among Gen X, and even up to 27% among the over 75’s.

Mobile banking adoption by generation

Source: Cornerstone Advisors

Additionally, there are a number of other benefits that drive mobile banking:

- lower bank expenses thanks to saving operational costs for running bank branches, printing and delivery, additional workers, and so on;

- high user retention rates with push and in-app notifications.

For example, BNP Paribas admitted that they saw a 60% increase in App Store rating (from a 2.5 rating to 4 stars) after implementing targeted push and in-app notifications.

- high return on investment (ROI) as engaged clients use more services, stay with the bank longer, and complete transactions more frequently.

An illustrative example here is the Bank of Ann Arbor, a community bank based in Michigan, which succeeded in returning the money invested in a mobile banking app. In three months, the bank saw a 56% increase in revenue from transaction accounts, 90% in point-of-sale transactions, 10% in products held per customer, and 23% in ATM withdrawals.

We agree that FinTech is not the only reason that affected the rise of mobile banking, however, it is one of the major drivers that make traditional banks seriously consider implementing or refining their mobile banking services.

Fintech helps banks reshape payment infrastructure

No other banking service has seen more innovations than payments. Today, payments are becoming faster, more secure, and more embedded. In our article about the current Fintech trends, we mentioned what embedded finance and payments are and how they’ve invisibly entered our lives, so check it out.

Payments are a huge part of banking services, and generate 90% of banks’ useful customer data. So, a greater part of banking innovation affects payments in some way or another, and vice versa, payments affect the rest of banking services.

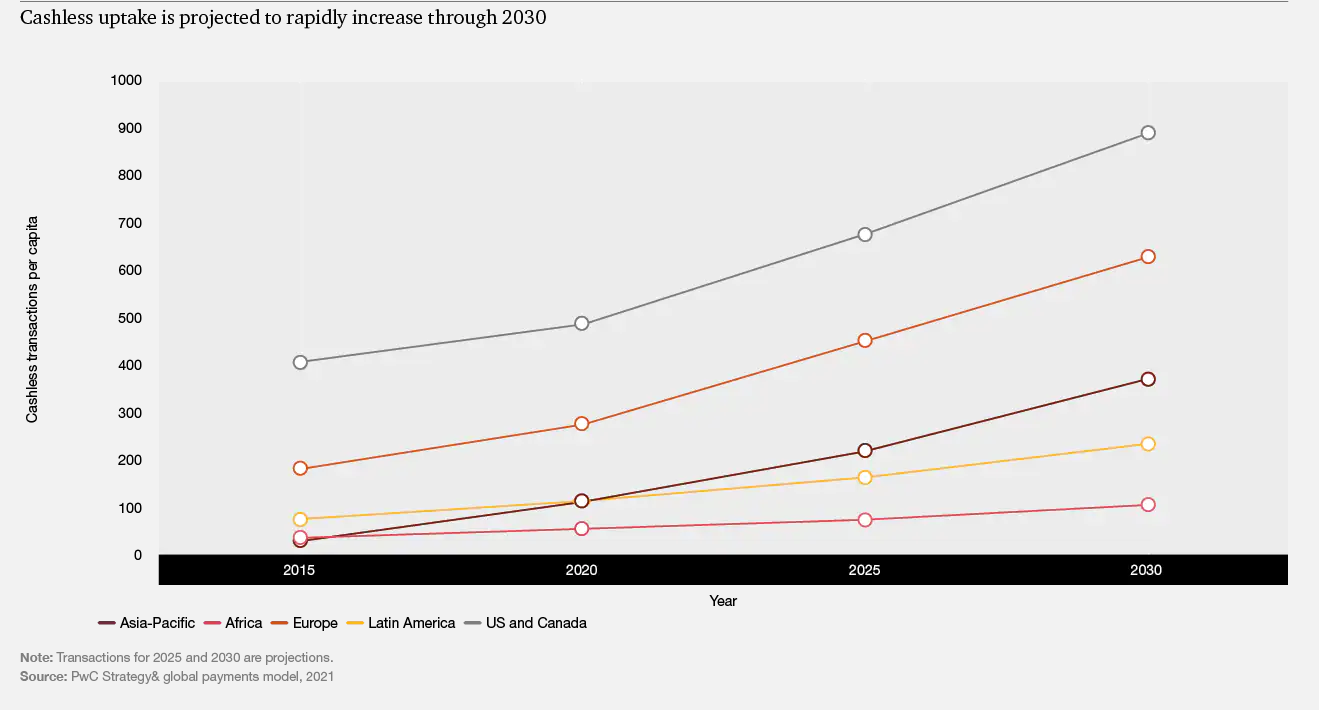

The majority of new payment innovations make way for a cashless society trend. According to PwC and Strategy analysis, cashless payment volumes will almost triple by 2030.

A shift to cashless brings about more serious and in-depth change. The cashless trend affects not only traditional ways of paying for services or goods but reshapes the whole infrastructure of payments and creates new business models.

This shift has two major trends at its core, which are:

- evolution of both front- and back-end parts of payment systems that involve instant payments, contactless payments, digital wallets, P2P payments, and so on; and

- revolution of the payment ecosystem that causes serious structural changes, for instance, “buy now, pay later”(BNPL) offerings, cryptocurrencies, digital currencies from the central banks, and similar.

World central banks are working on their own electronic currencies. The US’s draft of the Coronavirus Aid, Relief, and Economic Security Act considers the digital dollar as a means of overcoming a cash-flow crisis. At the same time, European, Swiss, and Irish central banks started similar projects to develop e-currency.

BNPL offering has changed the payment ecosystem almost overnight and forced traditional banks and payment providers to play catch-up. Moreover, BNPL has affected not only debit issuers but also credit card and personal loan providers. Such FinTech service providers like Klarna, Affirm, Afterpay, and others amid the COVID-19 pandemic succeeded with their BNPL services, significantly expanded their client base and increased revenues.

These trends influence the payments matrix around the globe leaving many banks and financial institutions at a crossroads deciding where and how to adopt these changes. JP Morgan has already shared key trends to drive its payments strategy in 2021.

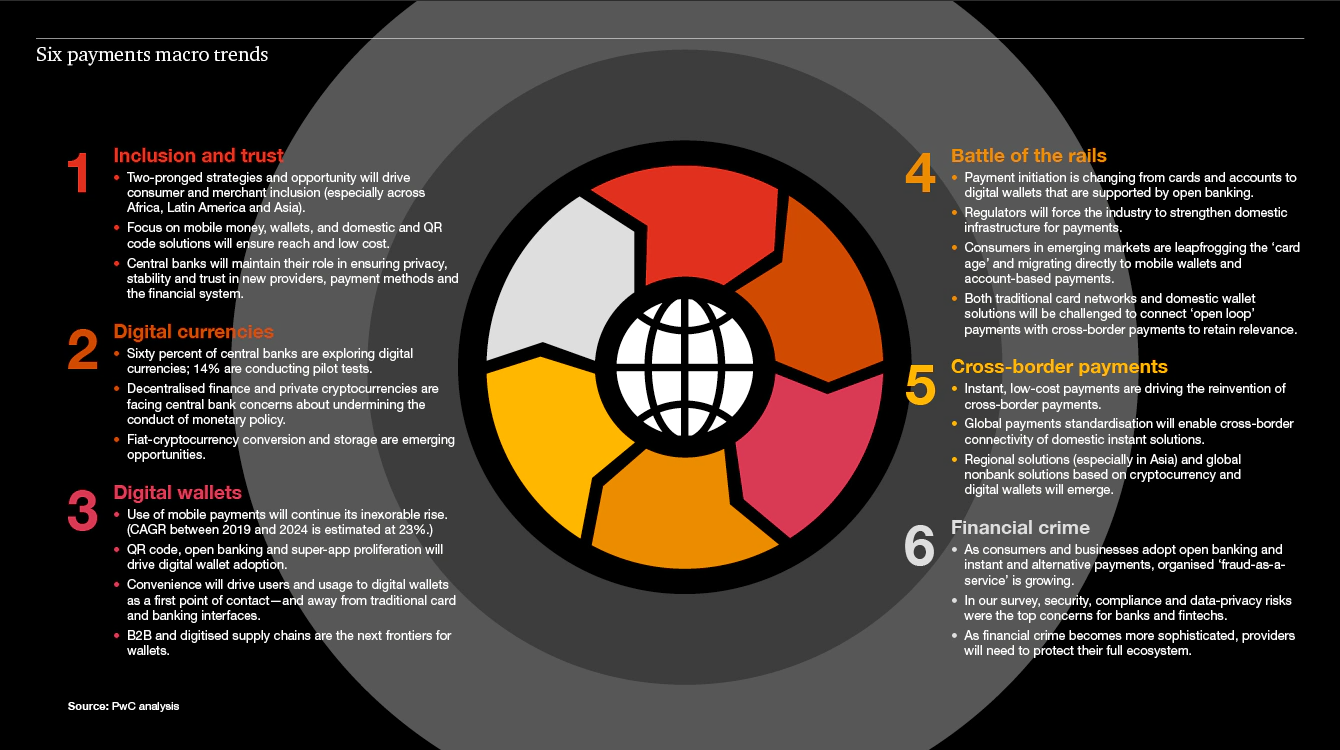

Summing up, the same Payment 2025 and Beyond report by PwC singled out six major macro trends that will change the payment system in the upcoming five years.

It’s very unlikely that traditional financial institutions will be able to fight all the changes needed on their own. This is exactly where we will likely see the close collaboration of FinTech and traditional banking organizations.

The report done by PwC proves this assumption. More than 86% of respondents agreed that traditional payment providers will collaborate with FinTech and technology providers for payment innovations.

FinTech helps banking refine the customer experience

For a long time, there has been a gap between what clients expect to receive in terms of customer service and what traditional banks delivered. FinTech companies focus on customer experience by using Big Data, AI, hyper-personalization, and other means and gave clients better customer service compared with traditional banks.

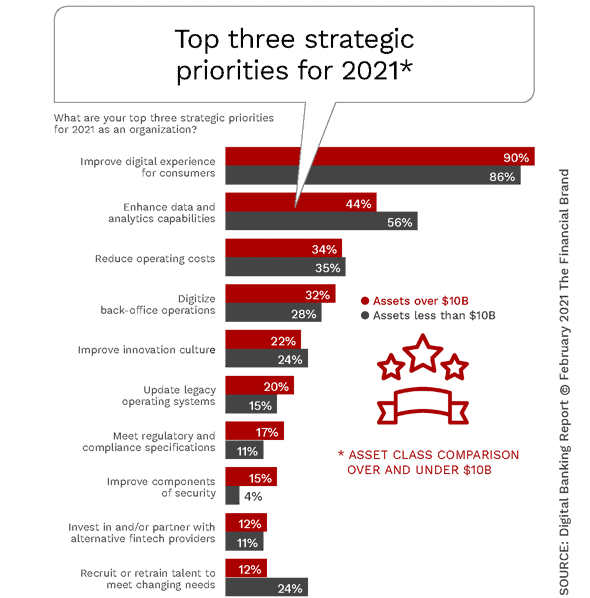

In response, financial institutions and banks have ranked ‘improving the customer experience’ as their top objective. That’s why this is a great example of how banks are responding to fintech innovations.

It should be noted that good customer experience is not a standalone marker. It consists of several components, like personalization, seamless omnichannel engagement, fast reaction on questions and issues, digital simplicity, and transparency. This is what banks are working on right now.

Banks are trying to simplify and make their digital products easier to use, provide twenty-four-hour support, use chatbots and personalization. For example, not long ago, Bank of America launched a newly designed mobile banking app with a more seamless user experience. The bank also tried to make the client journey as convenient as possible. They even promised to simplify its loan payments process by making it a two-click action.

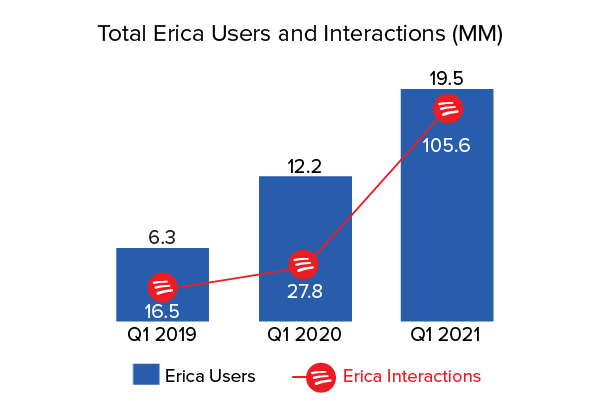

In addition, Bank Of America introduced Erica, a financial virtual assistant that helps clients with their everyday financial tasks and sends personalized recommendations, offers, and even educational videos.

The last quarter showed the growing popularity of Erica – the total user base of Erica now is 19.5 million clients, 7.3 million more than the same quarter last year. The number of interactions also increased.

Source: voicebot.ai

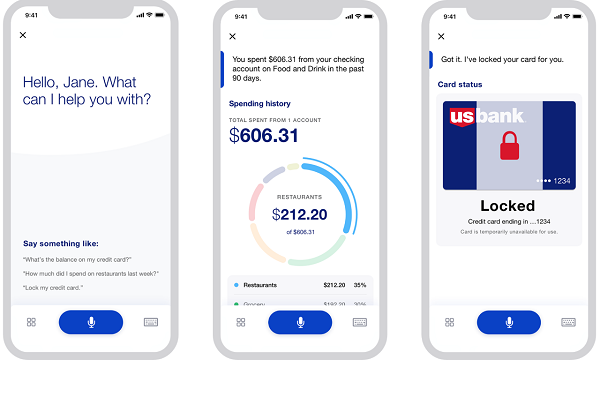

Sure, Bank of America isn’t alone in improving customer experience. U.S. Bank launched a mobile app voice assistant in Android and iOS apps, Capital One introduced a text-based chatbot assistant named Eno that helps people save money, HDFC Bank provided EVA, a 24/7 personal assistant to help clients with banking queries.

These are only a few examples of how banks are trying to retain and engage customers by improving customer experience using technology.

FinTech motivates banks to make better use of data

The banking industry has a huge amount of data, however, the most challenging thing about it is, making this data work for the bank. Most banks are not very good at using these rich data sets due to an unstructured approach to data processing, data silo, lack of technology, and so forth.

FinTech companies are ahead of banks in terms of data usage mostly because of their focus on business growth and gaining a competitive edge. There are a large number of new data-driven Fintech products in almost all aspects of financial services, from generating reports to predicting and minimizing financial risks.

The report made by European Banking Authority (EBA) showed the adoption of advanced analytics and big data in the banking sector is at an early stage. However, it also predicts that the growing use of Big Data, advanced analytics, and machine learning across the industry will rapidly evolve in the next few years. All this means is that the banking industry is moving in this direction.

We can already see this in action. There are examples of banks that use data for various purposes whether it’s customer analytics, personalized marketing, fraud detection, or prescriptive analytics for trading intelligence.

For example, the European bank tried different retention techniques to lower customer attrition, however, to no purpose. After the bank turned to machine-learning algorithms and predictive analytics that analyzed client behavior and predicted which active customers are likely to reduce their business with the bank, they managed to reduce churn up to 15%.

A US bank applied machine learning to study how private bankers offer discounts. The analytics showed the right algorithm of discounts which resulted in an 8% revenue growth within a few months.

Huntington Bank launched the Heads Up app that uses predictive analytics to analyze client transactions in real-time, identify spending habits, and provide valuable insights. By means of predictive marketing, Capital One provides its clients with personalized, highly relevant offers and services.

All these examples are real-world evidence of how data-based approaches can do a lot of good for the traditional banking sector.

Build your innovative financial solution with MindK

As you can see, the competition between banks and Fintech startups gave way to direct collaborations that does a power of good for both parties. So, if you plan to develop either a banking or FinTech solution, remember that partnership are now the core of success in the financial industry.

If you need an experienced software development partner to turn your idea into a working financial product, the MinK team is always ready to help you.

We are experts in financial custom software development, we’ve already helped our clients create web and mobile applications that process complex financial data at high speed, automate business processes, and make banking more accessible. If you’re interested in building a financial solution, fill in our contact form. Our expert will get back to you to set up a free consultation.