FinTech ecosystem is now worth more than $226.7 billion. Driven by changes in customer needs, it experiences fierce competition. Yet, fighting your rivals isn’t necessarily the best strategy. Experts agree that partnering with other institutions can solidify your market position and benefit all parties.

MindK has been following developments in financial technology for almost 10 years. Many things have changed since we integrated our first PayPal gateway. Yet, some things are just as relevant. Big banks are still reluctant to let go of legacy systems. Startups are just as starved for cash.

Yet, customers are more demanding and competition is at an all-time high. Thriving in this environment is hard, both for newcomers and incumbents. To help you build a successful financial products business, here are some of the most valuable insights we learned while dealing with FinTech startups.

So, let’s get the ball rolling!

Challenges driving the FinTech sector

The financial industry is going through a fundamental shift.

At the heart of this transformation is the change in customer expectations. We now have faster mobile networks, powerful devices, and creative apps we use anywhere we want. There’s no joy in having to travel to a bank branch and wait for hours in a queue to access basic financial services.

Lockdowns and social distancing have only hastened this trend. It’s now obvious, even for the slowest of banks, that digital is the future.

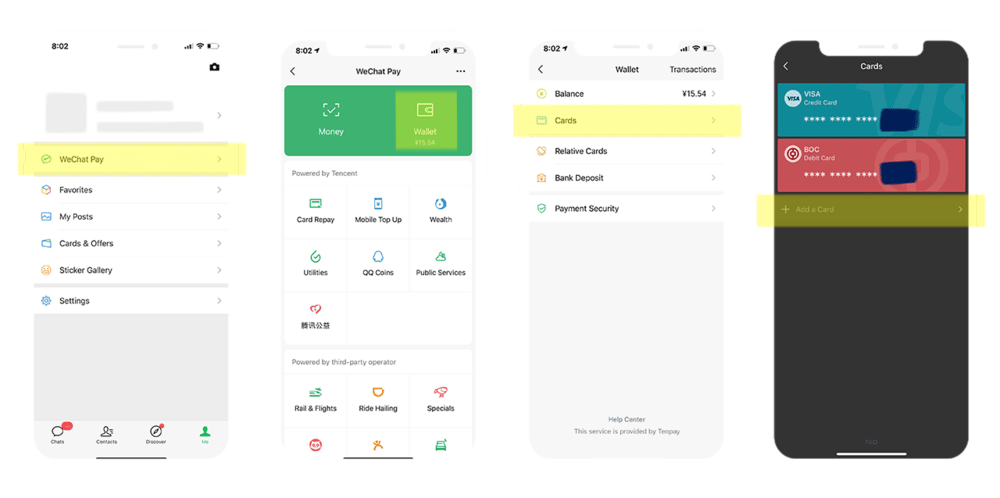

The problem is, the financial sector remains at the beginning of a digital transformation. Banks and legacy institutions can already feel the disrupting pressure of the Big Tech. Take, for example, Tencent’s WeChat.

What started as a simple messenger, soon branched into e-commerce, social networking, and online payments. In the end, WeChat Pay became one of the biggest players in Chinese FinTech with more than 990 million users.

WeChat Pay; source: Catalyst Agents

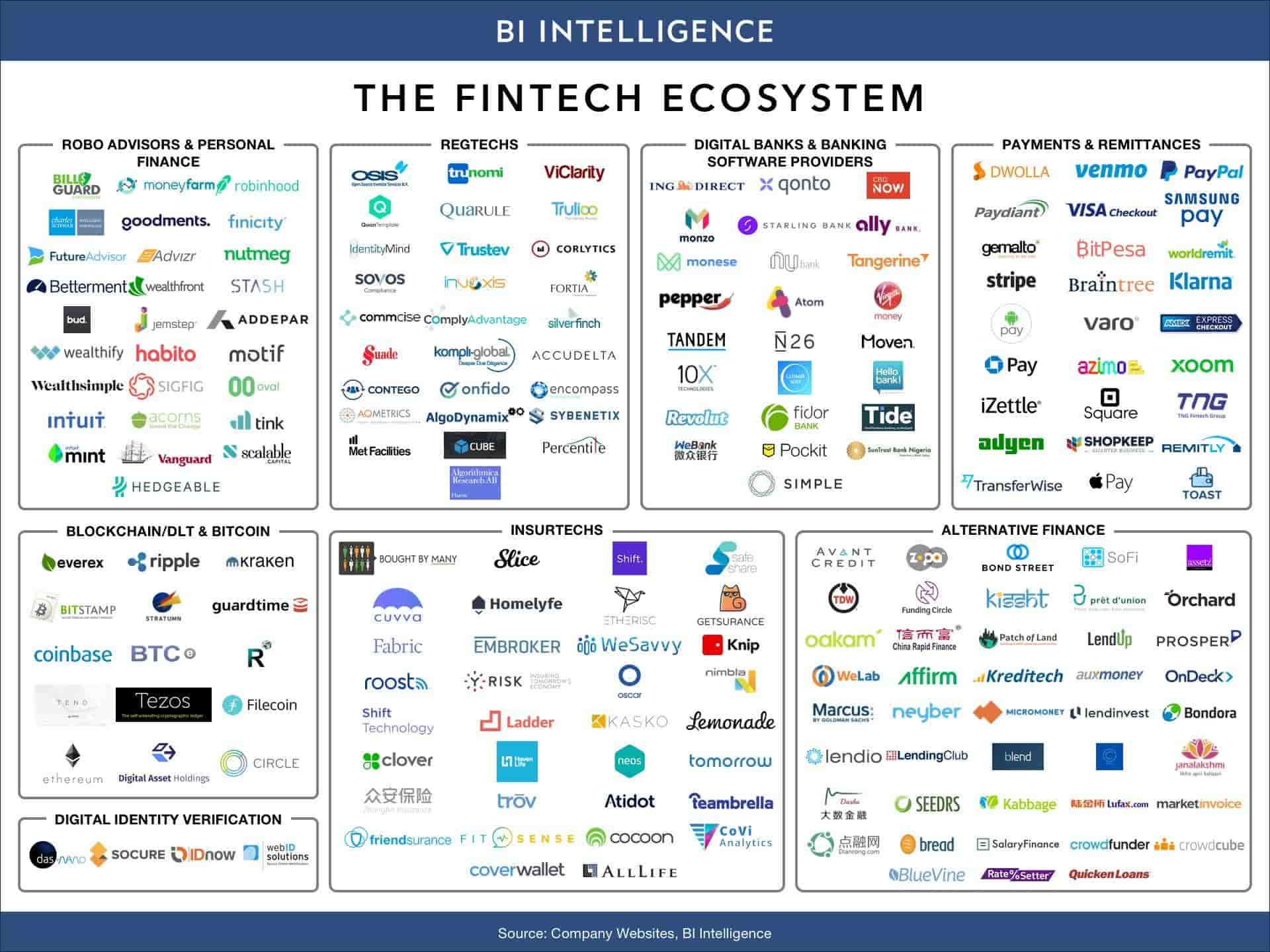

In truth, FinTech players can come from anywhere. E-commerce giants, tech companies, insurers, legacy banks, and financial institutions are all fighting over market share.

So, how can you achieve long-term success in a market with cutthroat competition and rapidly changing expectations? The answer might surprise you.

FinTech ecosystem map by Business Insider. You can learn more about the different types of financial software by reading our article

FinTech ecosystem as a solution

Many experts agree that the true FinTech winners will be companies that manage to build trust with their customers using:

- Regular touchpoints, both online and offline.

- Additional services integrated with the core offering.

- Excellent security and compliance with FinTech regulations.

- Powerful branding and digital presence.

This is where vetted companies with their large customer base and attention to compliance procedures have an advantage over newcomers. Startups, on the other hand, have something that legacy institutions lack – superior technology and willingness to experiment.

The winning recipe, therefore, might be combining these strengths in a partnership that benefits both banks and FinTechs.

So, what is a FinTech ecosystem? It is a kind of partnership that can include startups, financial institutions, investors, and government initiatives. The aim is to improve financial services with the use of technology, winning customer loyalty.

While in the past, banks aimed to build everything in-house, this mentality is slowly changing. Technology now changes so quickly, it becomes sensible to outsource than to upgrade internal systems on a continuous basis.

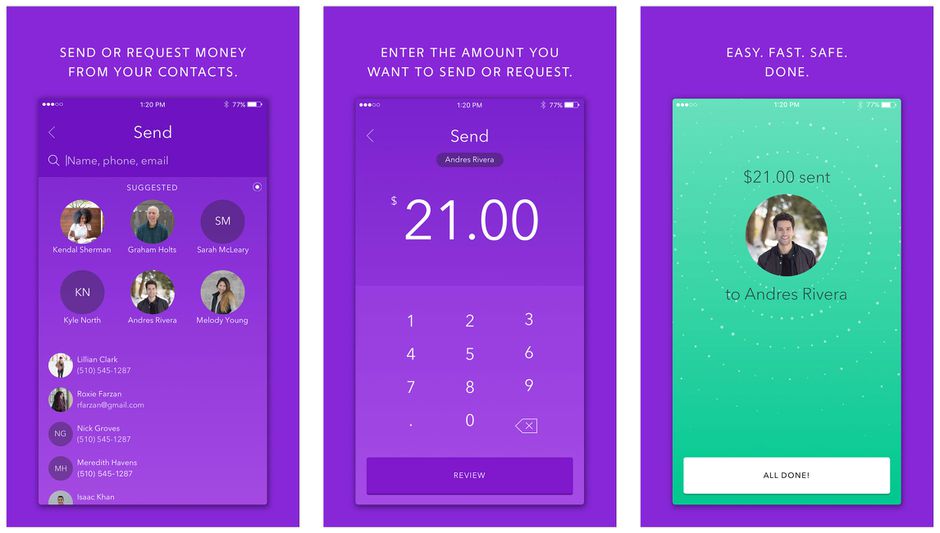

Take, for example, Bank of America – one of 7,000 institutions that partnered with a money transfer app Zelle. The integration allowed bank customers to easily send and receive money from relatives, friends, and acquaintances. As of Q2 2023, users have made over $192 billion worth of transactions using the app.

Sending money in Zelle app

Source: CNET

Building a FinTech ecosystem allows for greater integration between traditionally separate offerings. And the more value customers get out of a platform, the more loyal they become.

For traditional banking, partnering with FinTech startups allows building innovative customer experiences that benefit from the startup’s technological edge.

For startups, these partnerships can provide access to a large base of knowledge in areas like data protection, compliance, and risk management. Partnering with a trusted bank can lend you credibility and improve customer loyalty. Such institutions often have large investment budgets that can be of use to an early-stage startup.

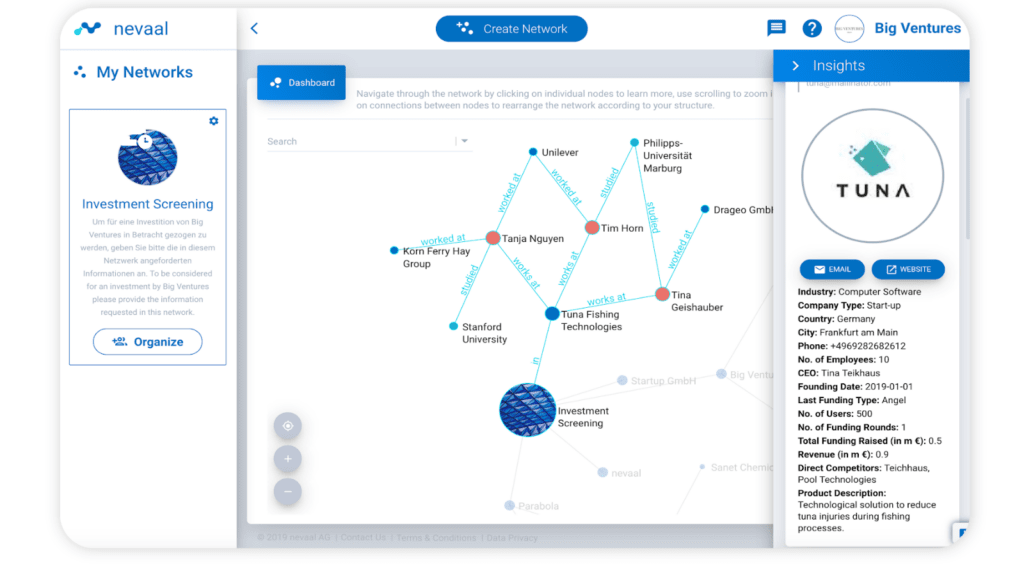

One way to create a FinTech business ecosystem is via financial commitments – mergers, acquisitions, and venture funds. MindK has seen firsthand how such a partnership can form while working on the Nevaal project.

The company was founded by Corvin Porter and Lea Roser, both graduates of Frankfurt universities. While working at a local university incubator, they had an idea for an app that would connect venture funds, startups, and incubators. MindK helped them build software that can visualize intricate relationships between individuals and companies in a startup ecosystem.

The next iteration of the product was expected to use Machine Learning to detect subtle connections and calculate investment risks. The problem is that implementing all of these features required additional funding.

This is when the startup attracted the attention of DekaBank, Germany’s second-largest bank. The bank acquired a majority stake in the company with a plan to build a SaaS solution on top of the Nevaal app. The aim is to allow other banks to utilize the networking technology to find opportunities for retirement investment.

Social network visualization in the Nevaal app

Source: nevaal.com

Open banking APIs as the main driver of the FinTech ecosystems

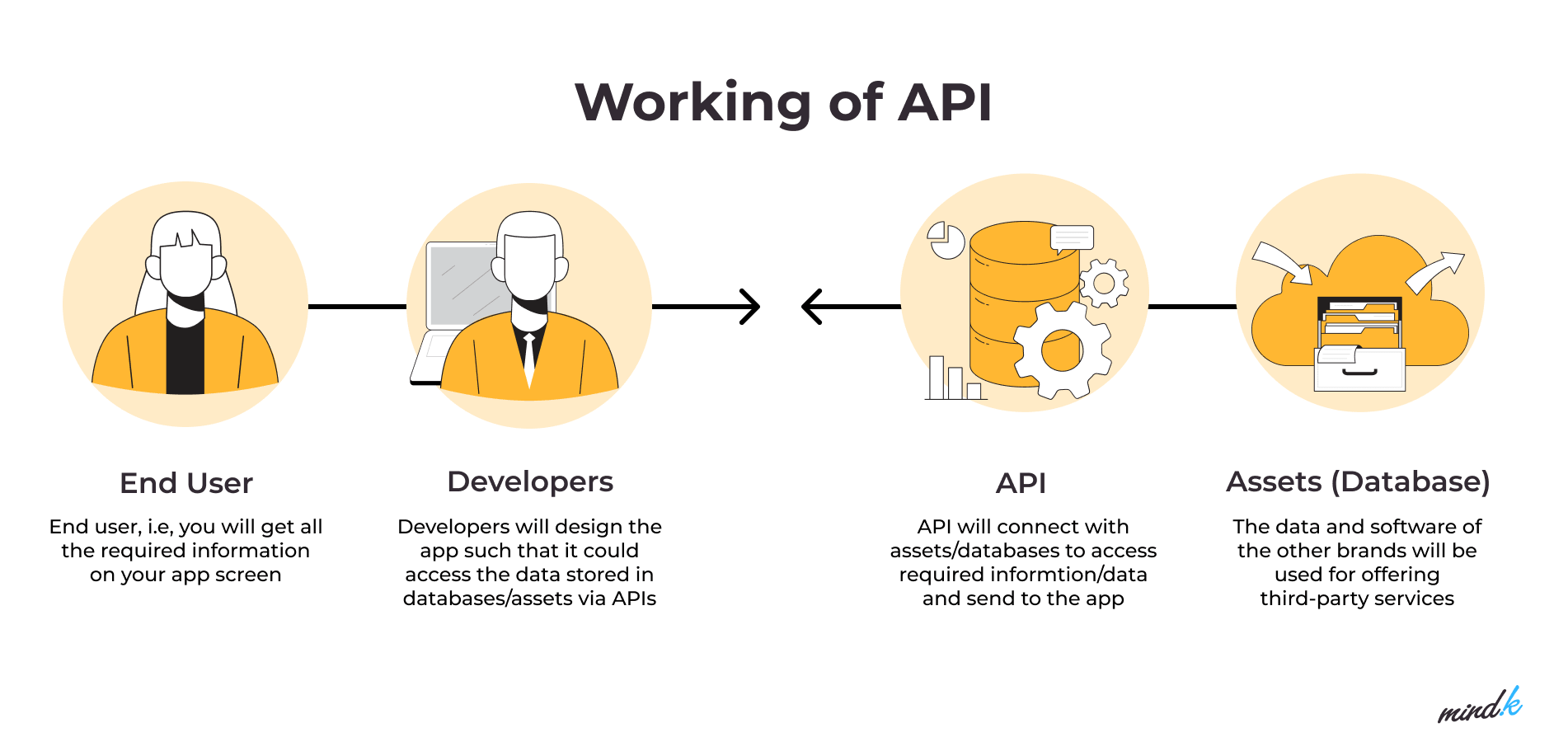

Most FinTech partnerships are only possible due to Application Programming Interfaces (API).

They represent a special language that allows developers to easily connect various apps and services. This way, you don’t have to reinvent the wheel when building a new product. You simply use features developed earlier by other companies, for example, Uber didn’t have to make the payment and geo-positioning technology. It simply integrated Google Maps API and the Braintree gateway to enable payments.

APIs lower the barrier to FinTech innovation and promote the rise of vibrant ecosystems. With their help, FinTechs can use the inventions of other companies, focusing all attention on perfecting the customer experience.

Among the most popular APIs in FinTech are payment gateways, compliance & regulation (RegTech), Anti-Money Laundering (AML), and Know Your Customer (KYC) services.

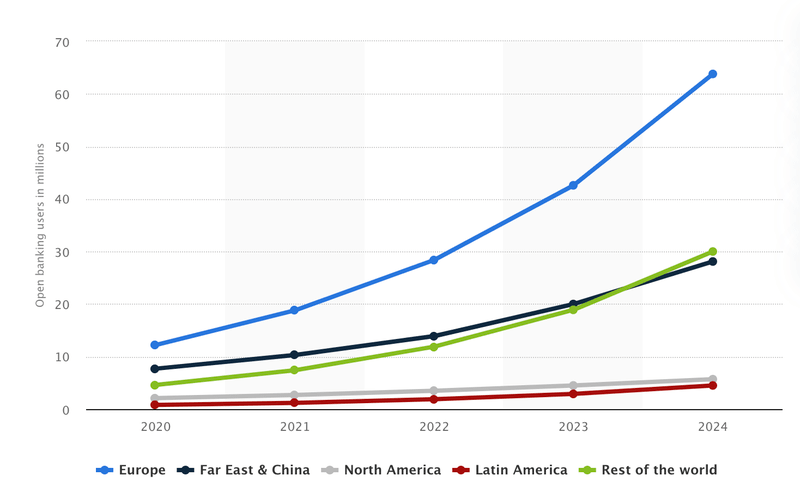

But the most important of the trends that power FinTech industry growth are the Open Banking APIs. They were first introduced in 2018, with the 2nd edition of the European Payment Services Directive (PSD2). These APIs allow startups to freely access banking information, aggregate transaction data from multiple accounts, or even initiate transactions in third-party programs. All of these actions, however, require explicit consent from the account owner. The proposed use cases include:

- Online payment services.

- Loans with automatic credit history checks.

- Fund management across numerous accounts.

Open Banking helps financial teсhnology companies of all sizes develop innovative services.

Number of open banking users (millions)

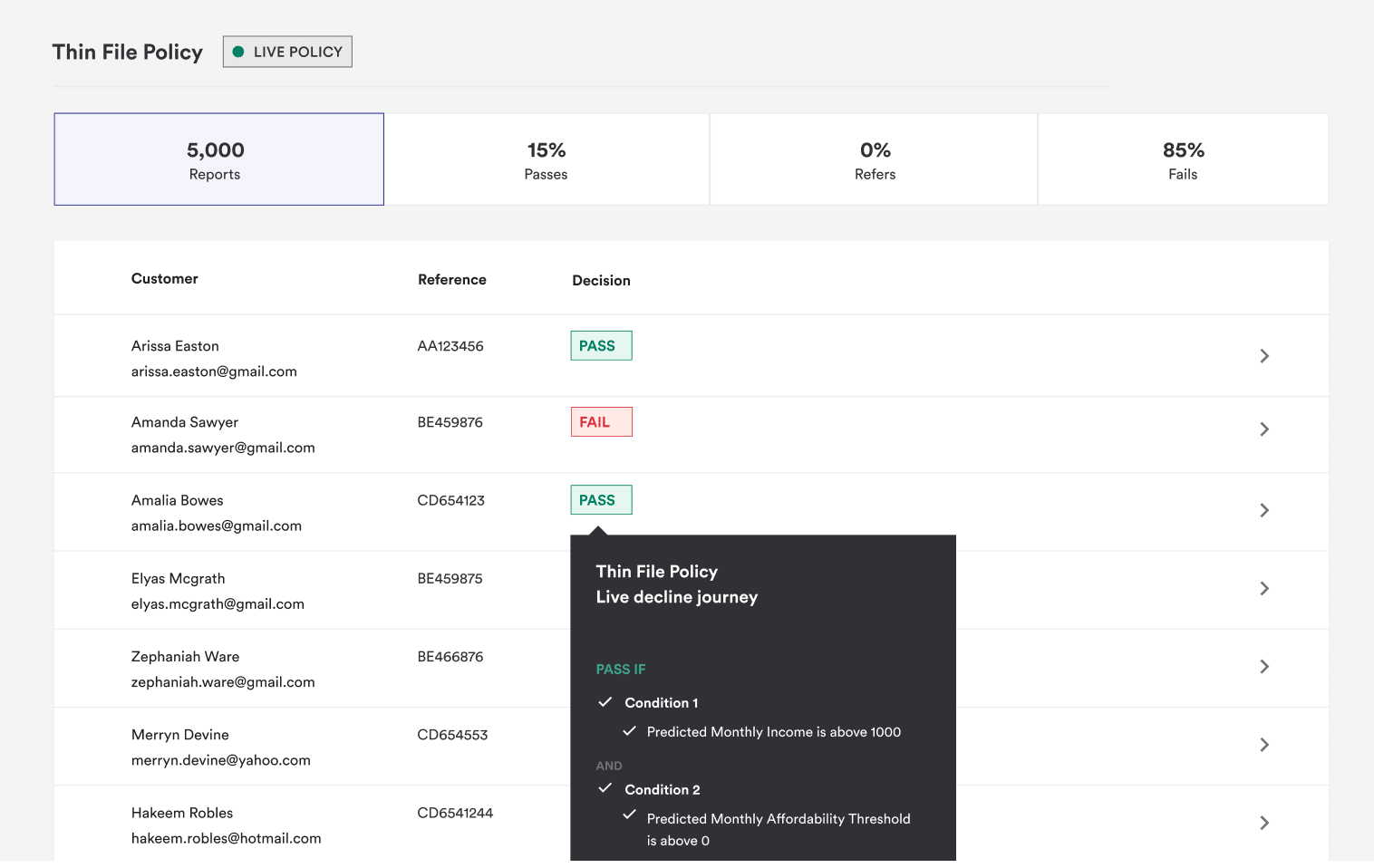

For example, Credit Kudos is a London-based startup that uses APIs to measure customer creditworthiness. Its founder, Freddy Kelly, moved to the UK with a very slim credit file. This meant he couldn’t get a loan with low interest rates. His research revealed that thousands of people in the UK had a similar problem. This gave him the idea of an app that would analyze transaction histories via an Open Banking API to verify the person’s income, calculate risks, and make automated credit decisions.

The company has raised £7.8 million and partnered with numerous businesses, accelerators, and government initiatives before an Apple acquisition in 2022.

Credit Kudos Open Banking Decision Engine

Source:creditkudos.com

Banking-as-a-Service (BaaS) is another big thing among FinTech industry trends that utilizes APIs. The partnership works in the following way:

- One company has a banking infrastructure. It builds an API that opens up the infrastructure on a pay-as-you-go basis.

- Other companies use the API to connect their apps to the banking infrastructure. This way, they provide banking services like payment processing, checking balances, or viewing transaction history without having to re-make everything from the ground up.

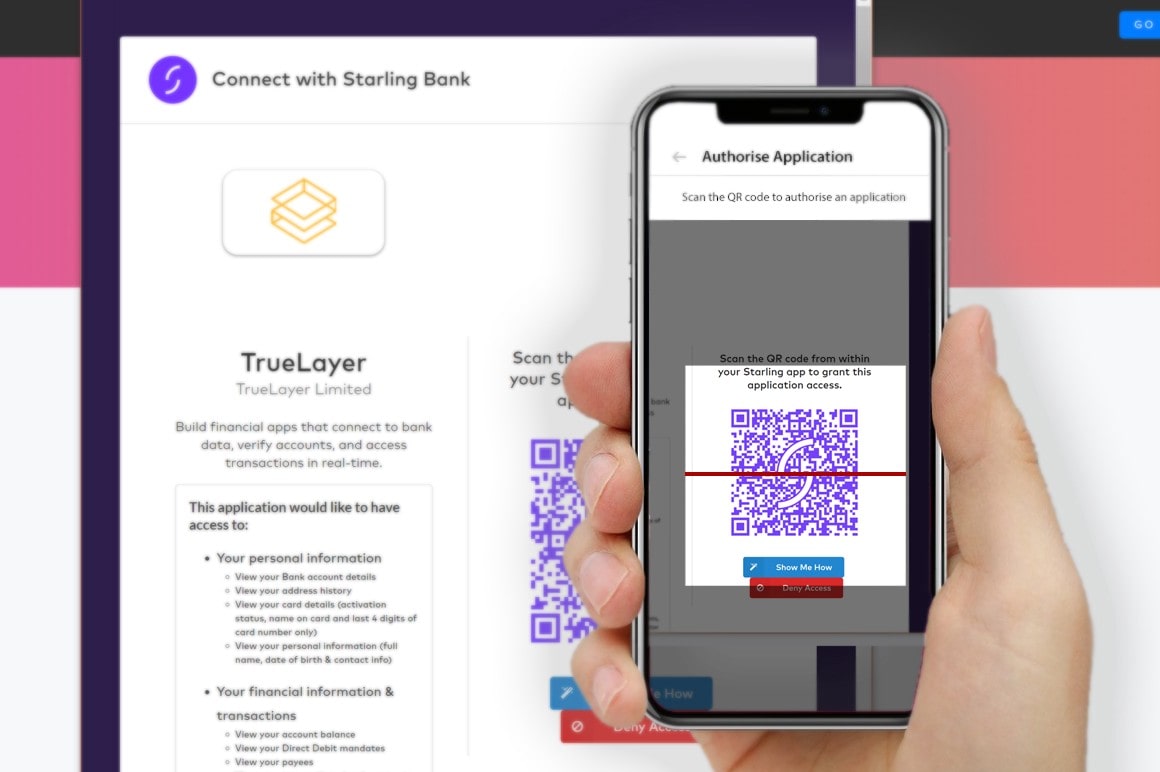

Starling Bank is one of the top players in the BaaS field. It provides APIs that can be used for everything from account creation to initiating payments. One of its main advantages is simplicity. Starling Bank APIs can be implemented with just a few lines of code, allowing other startups to develop new products like current accounts with minimum effort.

The simplicity seems to pay well for the company. Starling Bank is valued at $1.5 billion, with partners ranging from Railsbank to Vocalink, AccessPay, and Vitesse.

Login using a QR code scan, made possible with Starling Bank API

Source: truelayer.com

Entering a partnership can be of great benefit to a FinTech startup, especially early on. As you have limited time and money, re-inventing technology becomes a costly diversion. Take, for example, our partners at AlreadyOn. They’ve implemented a number of readymade features using simple API connections:

- BankID partnership for secure log-in and electronic signatures. The integration allows identifying users and signing documents like shipment orders.

- Integration with the Norwegian mobile payment system Vipps for paying membership fees without leaving the system.

- Norsk Pensjon/Axio integrations for automated insurance and pension calculations.

How we simplified insurance and pension consultancy for our Norwegian partners [Explore the case study]

Conclusion

Customer needs are changing rapidly and their expectations are increasing. This forces competition, both from young startups and seasoned players. Many experts agree that the long-term winners in this fight will be the companies that manage to build trust with their customers via regular touchpoints.

This means unbundling your services to offer an umbrella of targeted products or partnering with other startups and legacy institutions.

This way, your FinTech ecosystem – a unique network of partnerships you have with FinTechs, legacy institutions, regulators, investors, and consumers – can become one of your main edges over competitors.

In the last 10 years, MindK has been a reliable tech partner to more than 170 companies. We know how to take care of technology so that you can focus on building your business and perfecting your customer experience. So if you need a team of experts for your project, you can always rely on MindK. Just fill the contact form and we’ll arrange a free consultation!