MindK has seen firsthand the rise of FinTech. Back in 2012, when we first implemented PayPal in one of our apps, nobody knew what to call the tech that was quickly changing the way we interact with money. From 2015 to 2019, FinTech adoption was doubling every 2 years. Now 96% of consumers know at least one FinTech service and ¾ of them have used one before.

The current FinTech industry growth rate is fueled by 3 key trends, which we are going to discuss further in the article.

Table of contents:

Open Banking APIs provide opportunities for innovation

Open Banking became the biggest innovation in the financial sector since the invention of payment cards. For ages, banks have stored every transaction we made, from buying a coffee to paying a mortgage. Until recently, most of that information sat uselessly on bank servers.

Open Banking makes this information available to third-party service providers. It was first defined legally in 2018, in the second edition of the EU’s Payment Services Directive (PSD2). The directive outlines two types of providers that can benefit from Open Banking:

- Account Information Service Providers (AISP) can access the data stored at a customer’s bank account. Such services can aggregate data from multiple data accounts and use it to provide analytics or services like a mortgage application.

- Payment Initiation Service Providers (PISP) can also access the customer’s bank account to initiate a financial transaction from a third-party app.

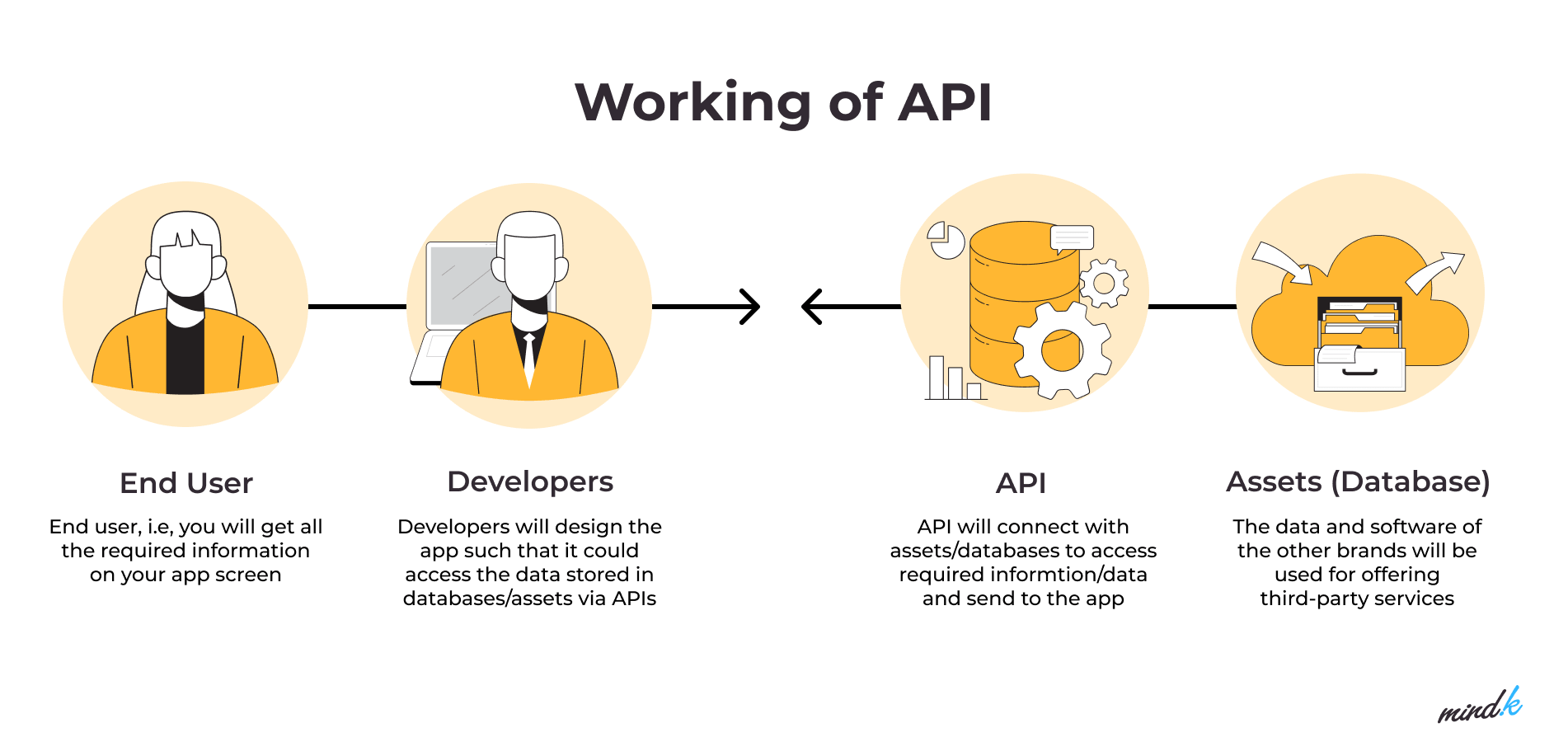

Both types of services require the explicit consent of the information owner – the account holder. European banks are required to provide a secure way to access this information in the form of Application Programming Interfaces (API).

APIs act as bridges that connect the client’s bank account with third-party apps, help them exchange data, and initiate payments in a safe fashion. Most of the FinTech-related projects we build at MindK involve creating robust APIs, so if you want to learn more about the technical details, check our article on API development.

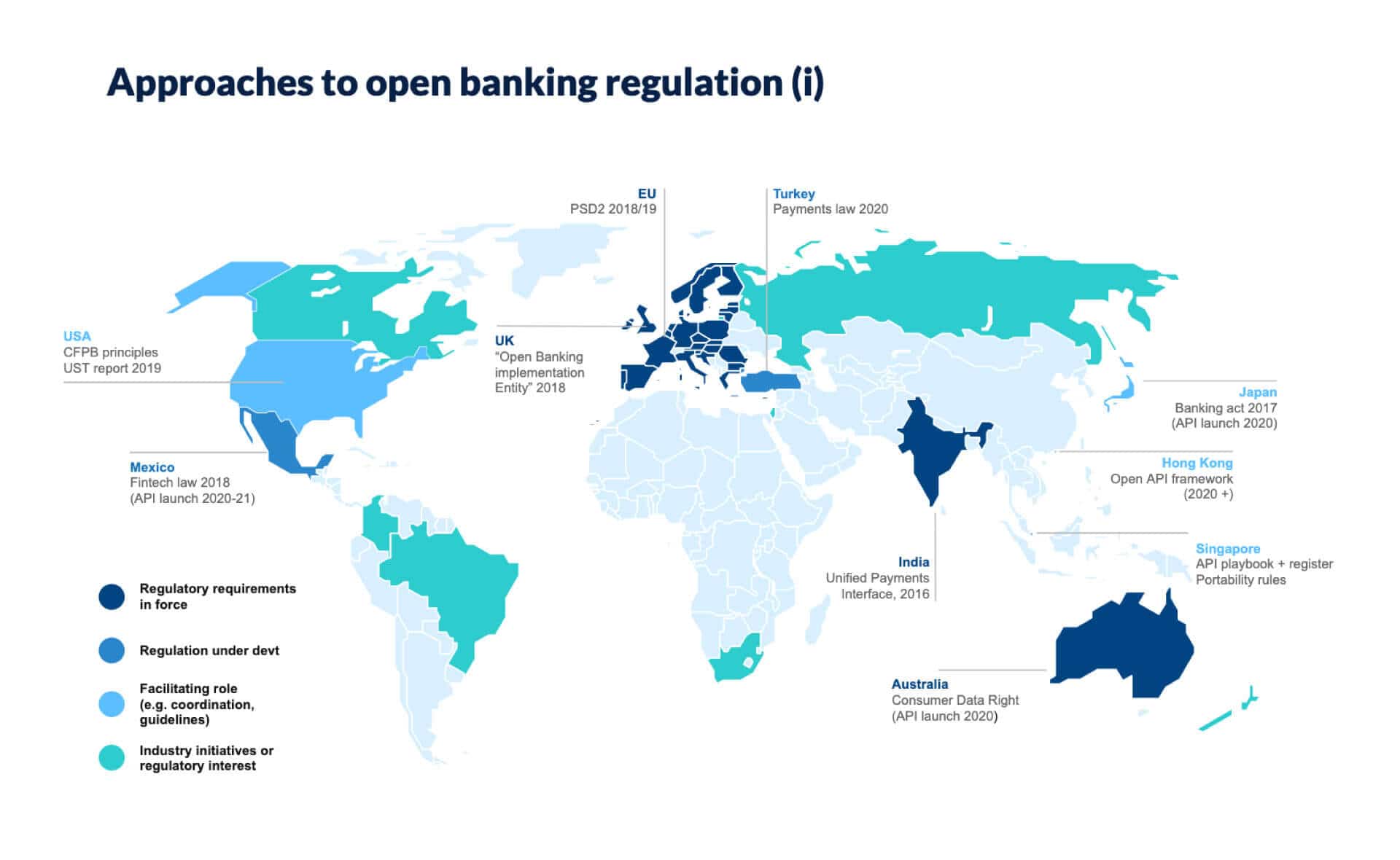

The UK obliged 9 of its largest banks – HSBC, Barclays, RBS, Santander, Bank of Ireland, Allied Irish Bank, Danske, Lloyds, and Nationwide – to open up their data in a secure and standardized form. In 2018, the UK government created the Open Banking Implementation Entity that oversees technical standards and guidelines for the UK FinTech sector.

Across the Atlantic, regulators have been slow to adopt the new standards. Without centralized regulation, the US FinTech has been left on its own to adopt Open Banking, which has created both confusion and opportunities.

The three biggest financial companies in the US – Fiserv, JHA, and FIS — have all implemented Open Banking strategies. The APIs they provide open up the data and functionality of their core offerings (which often use older technologies). US FinTech companies are implementing different workarounds. Some are building modern API-first platforms, others like Temenos or Finxact are making their own APIs that sit on top of older systems to abstract the complexity.

FinTech regulations in different countries across the globe. Source: bbva.com

Despite the slow initial rollout, Open Banking is revolutionizing the FinTech sector. The newly available banking data can be used in numerous ways:

- Managing money across several banking accounts via unified dashboards.

- Taking a loan with automated credit history checks.

- Making payments online directly from the person’s bank account and so on.

While large banks are, perhaps, the first thing that comes to mind when thinking about Open Banking, financial companies of all sizes are starting to reinvent their digital strategies. One attractive path is the unbundling of financial services.

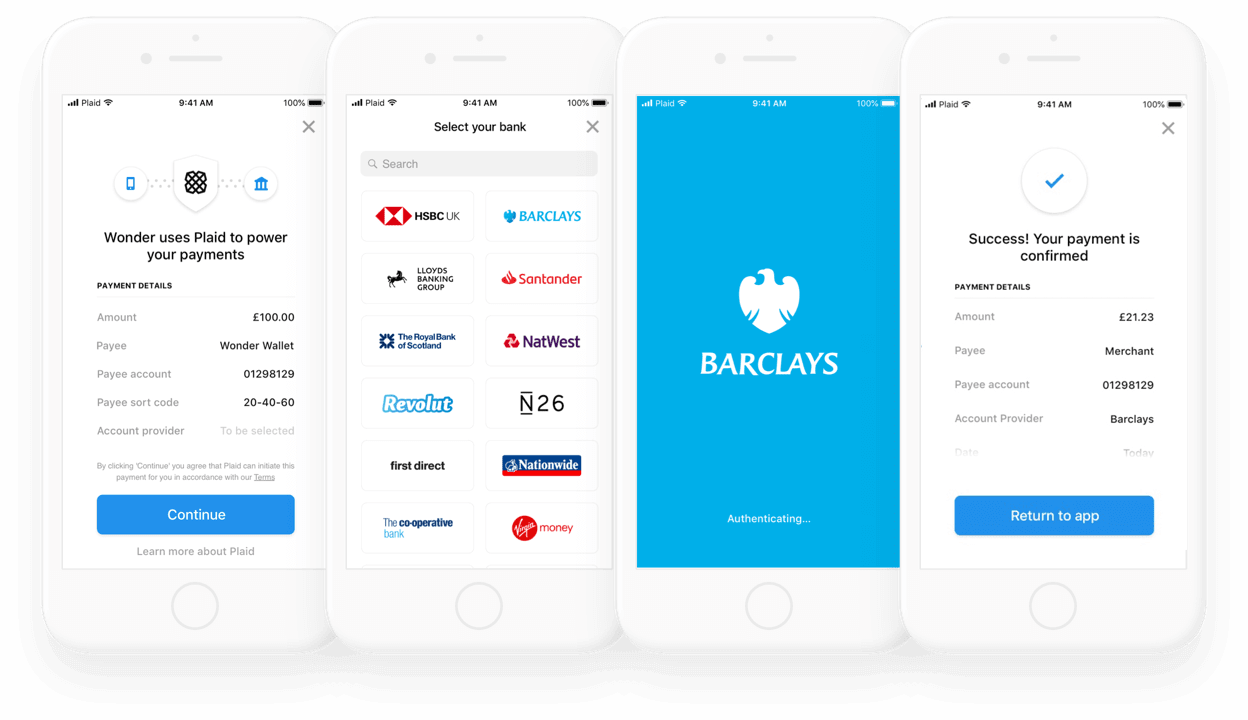

Plaid is one of the top Open Banking startups on the FinTech landscape, worth $13.4 billion. The San Francisco-based company helps other FinTech startups like Robinhood to connect to customer bank accounts, view balances, and make payments online.

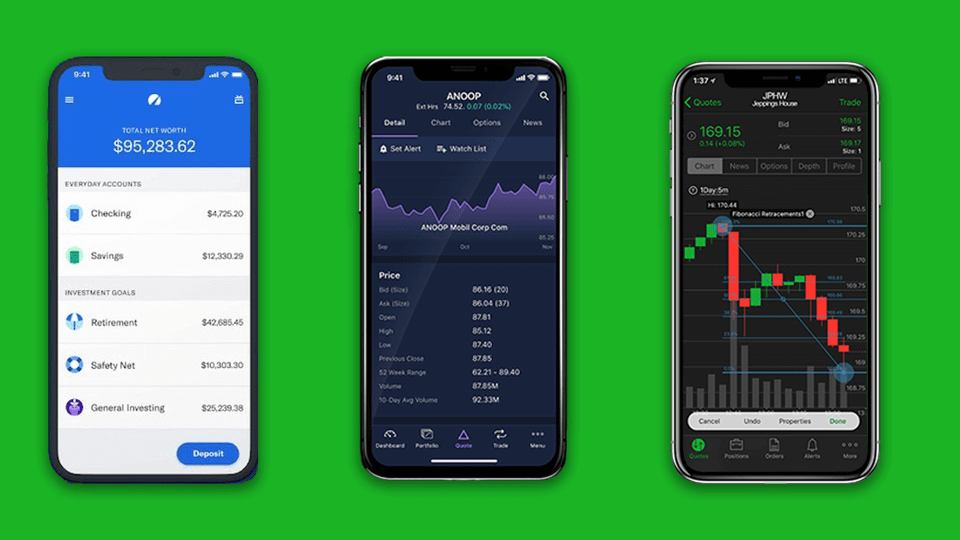

Plaid app. Source: plaid.com

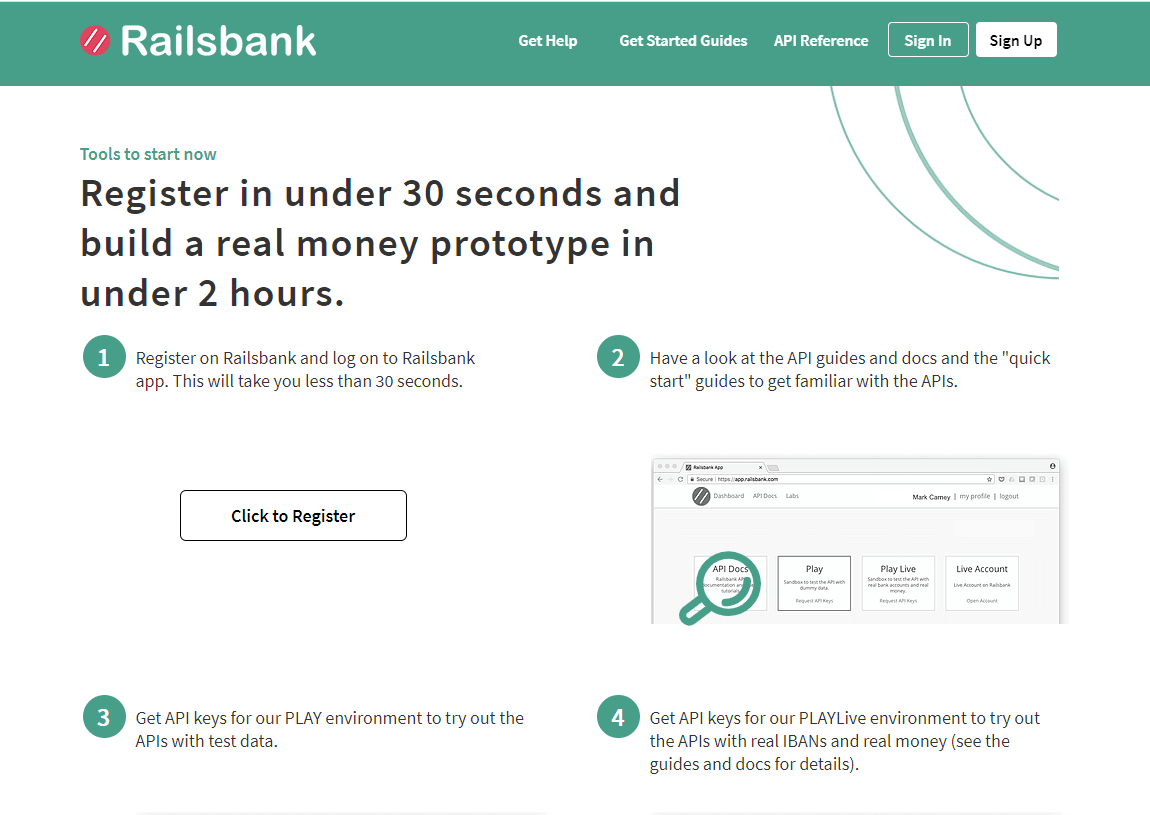

Banking-as-a-Service (BaaS) is another of the FinTech industry trends that uses APIs to provide non-financial businesses with access to the banking infrastructure.

Railsbank is one of the top players in the BaaS field. The London-based startup offers a platform for accessing global banking services like IBAN accounts, credit cards, direct debit, currency conversions, receivables automation, money transfers, and credit management with the help of its API. After a recent series B round, the 6-year-old startup is valued at $121.3 million.

The “unbanked” are a huge untapped market

We tend to take for granted access to basic financial services. While the pandemic ravaged the world, many of us relied on contactless payments to get necessities delivered safely to our doors. Some countries like South Korea, Sweden, and Norway are heading towards cashless societies where everything is paid with plastic cards.

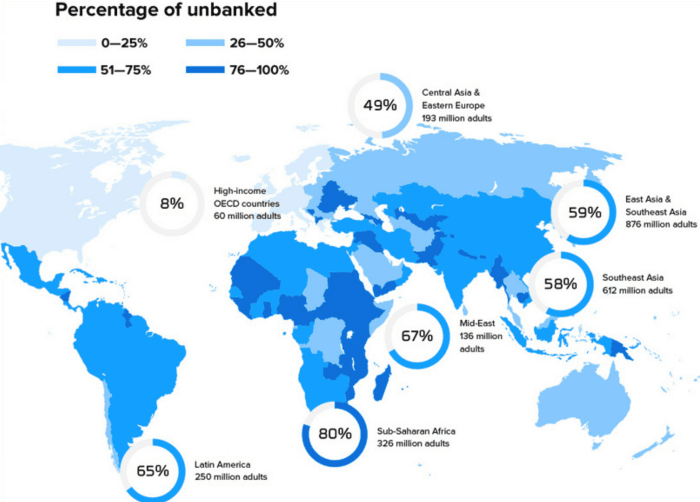

Yet, the same isn’t necessarily true for up to 2 billion people worldwide that have no access to financial services. Most of these so-called “unbanked” come from developing countries like China, India, or Mexico. Yet, even western countries suffer from financial exclusion. The US alone has almost 4.5 million unbanked.

What’s more, owning a bank account isn’t the same as having affordable access to financial services. The old-school banking system can be very expensive. Bank charges and overdraft fines stop billions of people from taking a loan or having a savings account. All in all, there are almost 4 billion of the underbanked who don’t benefit from the full range of financial services despite having a bank account.

Source: DataDrivenInvestor

As stated in the 2015 Accenture report, banks could increase their revenue by more than $380 billion by converting the unbanked into customers.

Serving this huge untapped market presents the biggest opportunity in the history of FinTech:

- Offer traditional banking services like money transfers and micro-loans but with substantially lower fees. Examples include Revolut, Azimo, and peerTransfer.

- Simplify banking services to make them more accessible to people without deep financial knowledge. By providing seamless, personalized services and education materials, these startups aim to change consumer behavior and improve their financial skills. Examples include Walmart, Cash Coach, and Finimize.

- Remove the barriers that prevent the unbanked from enjoying financial services. Examples include micro-loans, micro-pensions, or micro-savings from companies like Robinhood, Tala, or Grameen Bank.

- Employ advanced risk-prediction algorithms to make your services available to a wider group of people. By including other factors beyond financial data, such startups can help people improve their credit history and become successful entrepreneurs. Examples include Uber, Alipay, and ZestFinance.

- Target a niche concern like credit advances or partial salary-receiving. Examples include BitPesa, M-Pesa, and Wagestream.

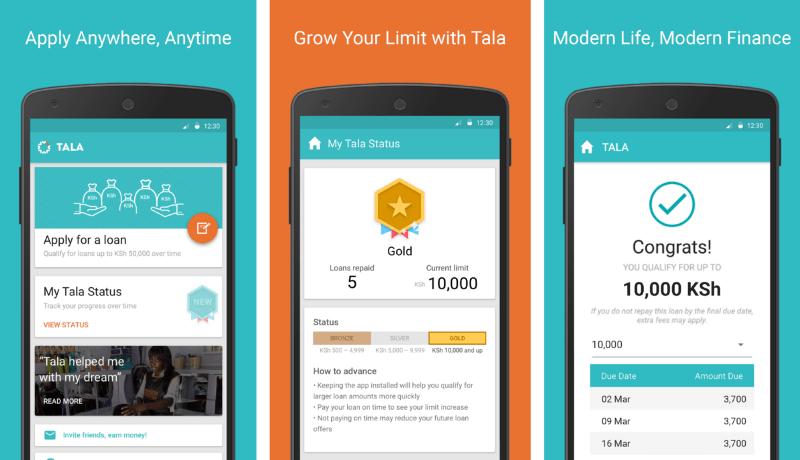

There are already some extremely successful technology companies serving the unbanked. Tala is a Silicon Valley startup that focuses on providing micro-loans via a user-friendly mobile app.

While working for the UN, its founder, Shivani Siroya, interviewed 3,500 people to assess the impact of microloans in Africa. She was shocked to see how many people were rejected by financial institutions when applying for a loan worth just a couple hundred bucks.

This experience gave her an idea for an app that could check a person’s creditworthiness via daily routines logged on their phone. The app uses over 10 thousand unique data points – things like calling your mom every evening or making utility payments on time indicate your dependability. The algorithm seems to be working – 90% of people repay the loan within a month. Tala now has more than 4 million customers, reaching a valuation of $516 million.

Tala micro-loans; source: Android Play Store

COVID-driven contactless payments

The pandemic became a black swan that changed the FinTech industry. 2020 saw the biggest ever wave of new accounts created in mobile payment, banking, and financial apps. European FinTech products and services saw a 72% boost in usage while top 7 North American neobanks increased their customer base by 39%.

Governments around the globe started encouraging contactless payments as a way to combat the infection. The proliferation of remote working, e-commerce, telemedicine, and e-learning have all contributed to the increase in online payments.

As safety becomes less of a concern, the desire for convenience will become the main driver for FinTech growth in the post-COVID world. Starting with 2021, we might see an increased popularity of the following types of financial software:

- Voice-activated and QR code payments.

- Finance automation (for example, rent and utility payments).

- Contactless neobanks.

- Robo-advisors.

- Biometrical security.

- Blockchain and real estate crowdfunding.

- Diversified payment options in online retailers.

- Further adoption of digital business models.

The pandemic’s positive impact on the industry is reflected in the valuations of some of its top companies. PayPal’s value skyrocketed from $143 billion in February 2020 to $340+ billion in February 2021.

Robinhood was another big winner. The startup offers a gamified investment and stock trading app without most of the traditional fees. Despite suffering technical malfunctions during the COVID-induced selling frenzy, the app gained almost 6 million new users in the first 2 months of 2021 and reached a market valuation of $35 billion.

Source: Mashable India

Conclusion

So, why is FinTech growing? In short, it’s our desire for safety, convenience, and availability that are driving the industry’s incredible growth. Technologies like Open Banking APIs, blockchain, and Artificial Intelligence give FinTech founders an opportunity to level the playing field and win over the legacy companies.

While in some sectors it might be too late to enter the competition, there are a ton of opportunities if you know how to create a FinTech startup that will thrive.

And if you need a team to help you with FinTech development, you can always rely on MindK. For the past 11 years, we’ve helped hundreds of clients take their project from an idea to working software. Feel free to fill the contact form and book a free consultation with our FinTech experts.