Fintech Software Development Services: Make Finance More Efficient & Accessible

Expertise in financial software development – we can help you build products that solve problems

Mobile banking app development

Meet the growing demand for remote banking services by building an application that lives up to customers’ expectations. We help neobanks and traditional banks innovate to increase customer satisfaction.

Insurance software development

Help insurance agents track commissions, manage tasks, process claims, do reporting, create invoices, make payments, and automate other administrative tasks using cloud-based solutions or mobile apps.

P2P lending software development

Build and launch a peer-to-peer lending or debt crowdfunding platform that automatically matches borrowers with investors. We can help you build robust risk assessment functionality to make accurate credit decisions.

High-frequency trading software development

Enable users to identify profitable opportunities and place trades to generate profits fast. We build software for crypto and stock trading that makes it possible for the information flow to move in real-time.

Mobile payment app development

Optimize splitting bills, sending remittances, exchanging foreign currency, transferring money across borders. We build mobile payment apps with wallet features that make sending and receiving money quick and easy.

Personal finance app development

Develop a budgeting app that helps people manage their finances, track spendings, and provides useful tips on how to manage money better. We build personal finance apps that link all the user’s bank accounts together.

Investing app development

Create a solution that helps people get into investing. We design and develop user-friendly applications that offer a variety of affordable funds to invest in, a possibility to trade, and stay updated on the market at all times.

Wealth management software development

Provide a solution for advisory firms that supports every step of the investment management process. We build robo-advisors and financial planning platforms that consolidate data and facilitate decision-making.

Overcome key challenges in fintech app development

Fintech isn't the easiest industry to target. But with a good financial software development company, you can overcome some of the major technical challenges.

- Fintech regulatory compliance

- High-speed data processing

- AI integration

- Advanced analytics and risk management

- Blockchain-based fintech

- Engaging customer experience

- Continuous delivery and automation

- Open Banking API integration

Selected case studies

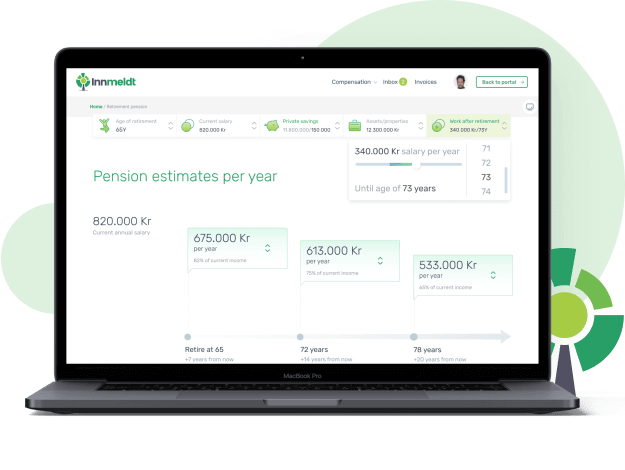

Automating employee pension and insurance calculations

Innmeldt is an insurance consulting agency that works with the human resource departments of top Norwegian companies. They needed a platform that automates complicated pension calculations and allows Innmeldt to serve more customers better.

We created a web portal that allows Innmeldt's customers to see the exact amount of retirement and insurance payments. The web portal can be customized for each company Inmeldt works with. It runs on top of a custom management system that we integrated with Aksio and Norsk Pensjon insurance systems for up-to-date data needed for calculations. This solution allowed Innmeldt to greatly expand its business.

Designing an energy trading platform

Our client is a Swiss-based energy trading marketplace that turns LNG & H2 into tradable and hedgeable commodities and offers real-time physical and financial trading, risk management, portfolio optimization, price discovery, and market analytics.

We helped our client design its trading platform. Some of the major functionalities we designed include a tender creation wizard and a dashboard that provides a quick overview of available trading options and market analytics.

Why MindK

Develop your software with MindK

Let us know about your challenges and we'll

help you resolve them.

Frequently Asked Questions

- How does your fintech software development process ensure compliance with international financial regulations across different jurisdictions?

We incorporate a comprehensive legal and regulatory review in the initial phases of fintech software development. We consult with legal experts to ensure that the software complies with international financial regulations, including KYC and AML standards, adapting to the specific regulatory requirements of each jurisdiction where the software will be used.

- What approaches do you take to ensure data security and prevent breaches?

To safeguard against breaches, MindK employs a multi-layered security strategy, incorporating encryption, secure cloud services and data storage, regular security audits, and penetrations testing. Based on your requirements, we also implement advanced threat detection and response mechanisms to identify and mitigate potential security threats promptly.

- How do you facilitate the integration of blockchain technology in fintech applications?

In integrating blockchain technology, MindK addresses challenges such as scalability, interoperability, and regulatory compliance. We use a combination of custom development and existing blockchain frameworks to create secure, efficient fintech applications that leverage blockchain for transparency, security, and trust, while ensuring the solution can scale and interact with other systems or networks as needed.