One of the first questions that people who want to develop a financial solution ask is “How much does it cost to build a fintech app?”. Although the request that can involve anything from creating a simple personal finance app to a feature-rich investment solution, everybody need to know the numbers.

Here at MindK we’ve been developing custom software projects for more than ten years and haven’t seen two identical projects. Each custom-developed product, including those for the financial industry, has unique requirements and business goals that influence the final cost.

However, we’re able to provide you with enough information so that you can understand which components make up the cost of your FinTech software and how we, as a software development company, estimate the project (as well as why cost estimates are so hard to make).

Let’s dive in!

What makes FinTech app development cost estimation so difficult?

Another question that most business leaders focused on building FinTech apps face is “Why is it so hard to find out the development cost?”

The main reason is that the estimation process is quite a challenging task. In our experience, the uniqueness of the solution is not the only reason that makes estimation blurry. We singled out a few more reasons, among them being:

- Lack of time and understanding of the project: estimates are very often needed in a short period of time before a team could produce clear specifications of the solution requirements. A typical situation is when a software development company is being pressured to provide a cost estimate too quickly for a solution that they do not yet fully understand.

- Inability to form clear, complete, and reliable specifications early on: it is complicated to flesh out an explicit set of requirements, especially at the start of a project. Quite often even business owners have just an idea and cannot clearly shape the requirements. In this situation, we suggest starting with validating an idea on the market by means of a Minimum Viable Product (or MVP), a basic version of the app with valuable features only.

Rapid changes both in information technology (IT) and the business environment: changes in requirements are more of a rule than an exception. For example, it is difficult to predict how long it will take to make an integration with a third-party system you haven’t worked with and what hidden issues the process may result in (this requires a more detailed investigation). It is further difficult to foresee shifts in the market that may turn a company’s business goals around. The COVID-19 pandemic lockdown is a great example of such a situation.

Using different estimation approaches: the truth is that it takes time to work out an effective approach to project estimation that does an accurate job. You likely have already faced various estimates of your fintech product idea or will face them in the future. Each fintech development company has its own approach, best practices, and experience that underlie the estimate (which may not be fully understood by the clients).

For example, there are clients who believe there is a linear relation between the required capacity per employee and the time available. This means that a solution developed by 10 people in one year could be accomplished by 20 people in six months. Our practice shows this assumption is wrong, as it may cause additional challenges that influence the result, like additional management efforts, changes in the development lifecycle, budget overruns, and other risks.

Here at MindK, we worked out an individual approach to cost estimation that includes a rough estimate that gives a client an average price range and our assumptions and a detailed estimate afterwards (we will discuss this approach in greater detail further in this article).

Variable factors that make an impact: there are several factors (usually referred to as cost drivers) that have a direct impact on the effort and time to develop FinTech software. These are exactly the factors that all business leaders should be aware of, and why we are going to discuss these cost-driving factors more specifically.

Key cost drivers that influence a FinTech app development budget

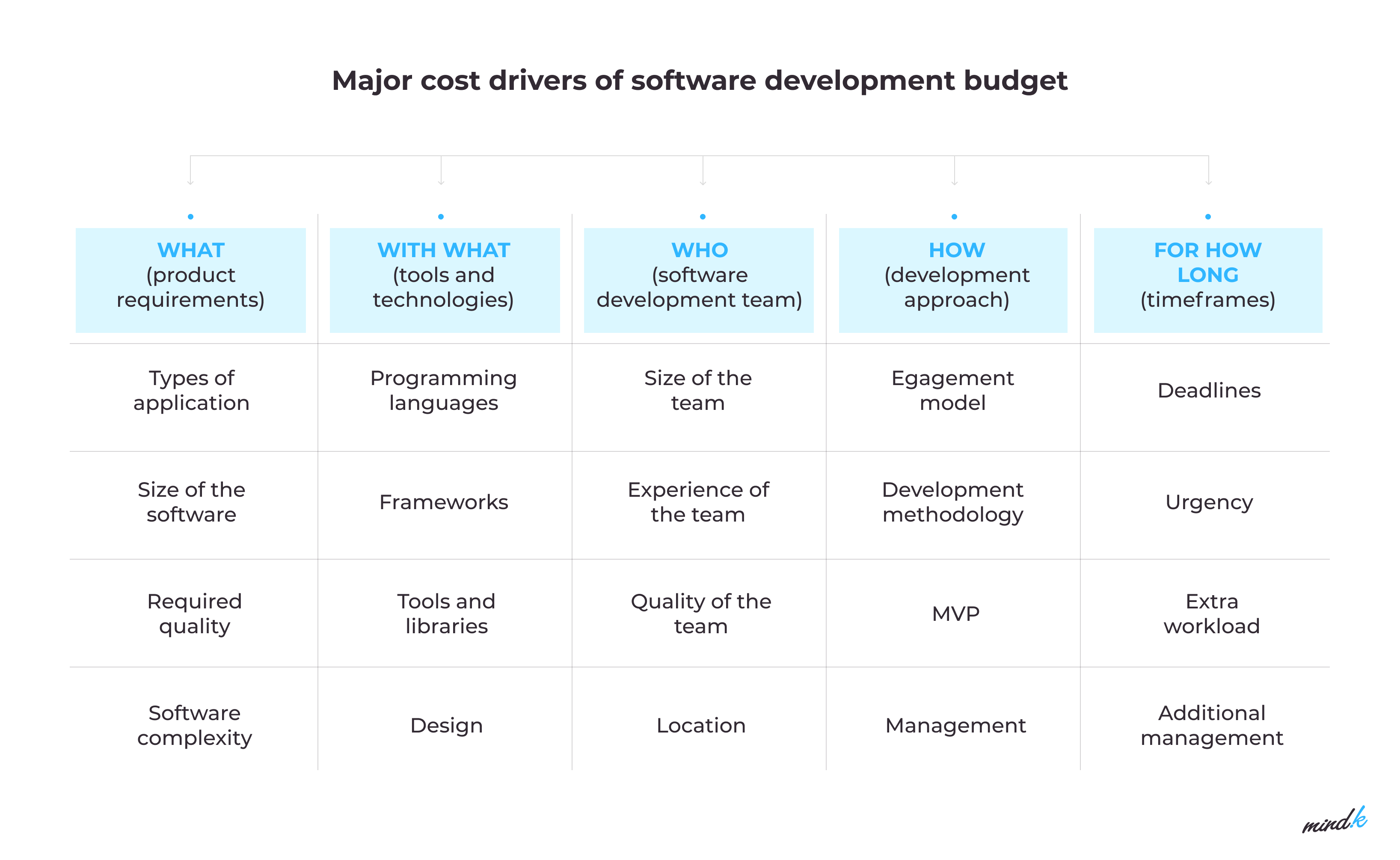

There are a number of variables that have an impact on FinTech app development cost and duration. However, we’ve singled out the most significant ones that need to be considered. We divided them into five groups, each of them answering a certain question, namely WHAT, WITH WHAT, WHO, HOW, and FOR HOW LONG.

#1. WHAT (product requirements)

The first factor that mostly influences the cost of a FinTech application is the requirements. The software requirements include a scope of work (that defines the size of the project) and the complexity of the product.

The scope of work is a set of features the financial application is required to have or the amount of work required to develop these features. The bigger the scope, the larger the project and the more hours it takes to complete development. It is quite straightforward.

Project complexity, in turn, refers to how complicated the logic of a software product is, no matter what types of fintech app we are talking about investment apps, banking, or insurance and pensions systems. Here are the main things that usually complicate the logic of the product:

- feature complexity;

- technical complexity (using APIs, Artificial Intelligence, Big Data, Blockchain, etc.); and

- design complexity.

If the product has a complicated logic, it is more challenging to develop, test, and deploy. Moreover, non-functional requirements also matter. They include various characteristics which describe how the application works, namely, scalability, security, usability, reliability, performance, etc. They are important because they influence the user experience.

Here are the types of fintech apps based on the scope and complexity (the cost estimates are average):

- Basic ($30 000+): because the financial industry usually involves solving complex problems, it is hard to think of an example of a simple FinTech app. Most financial solutions are medium, complex, or innovative. However, the basic category may include a prototype or a Proof of Concept of a more complex financial solution.

- Medium ($70 000+): a project that is more work-intensive, includes medium-complexity business logic and few or no integrations. An example might be an easy-to-use personal budgeting app or a Minimum Viable Product of a more complex solution.

- Complex ($200,000+): a project that includes advanced features like analytics, real-time synchronization, integrations with third-party services, custom UI/UX design, and so forth. It may be either a FinTech startup’s product or a complex solution to automate processes in a financial company.

- Innovative ($500,000+): a complicated custom application designed to revolutionize the market and provide a service or product that has no analogs in the market. The complexity and innovative nature of such solutions prevent objective evaluation of the total cost and timescales.

Key takeaway: the scope and complexity of the project are among the core factors that determine the cost of the app development. Based on the scope of features, a software development partner determines all the requirements and provides an average cost of the project.

#2. WITH WHAT (tools and technologies)

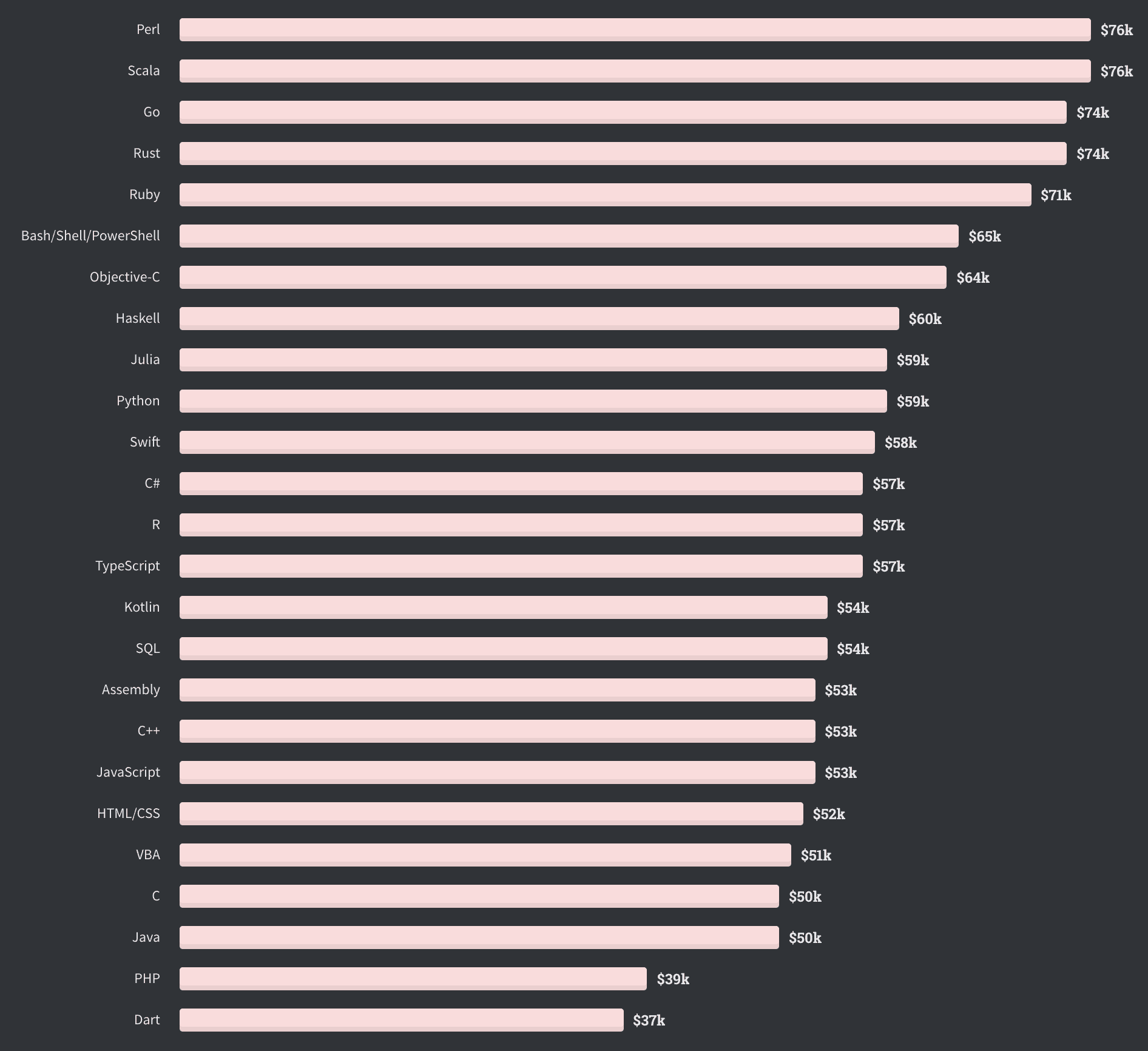

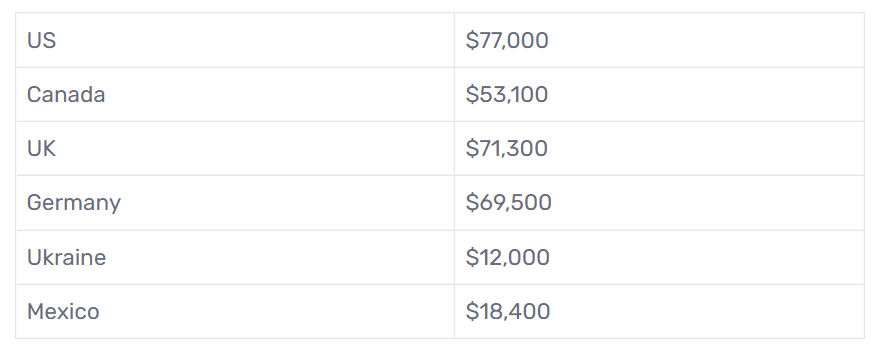

Software development cost is also highly dependent on the technology stack. To estimate the cost, you need to decide what programming language and tools you will use for your FinTech app development project. This factor is a cost driver because each programming language, framework, and tool has its specifics. As a result, the salaries of the developers may also vary.

For example, according to the StackOverflow Developer Survey 2020, the average salary of JavaScript developers globally is $54k a year, while Perl and Scala developers earn on average $76k annually.

Source: insights.stackoverflow.com

This is a global statistic, however, the average salaries of developers in the USA are usually twice higher. For comparison, JavaScript developers in the USA earn $112K while the average annual salary of Perl and Scala developers is $130-150K. In Ukraine, JavaScript engineers on average without reference to experience and level of Seniority is $38K a year, while a Perl and Scala developer is likely to earn $50K.

In this light, you see that the location of the developers also matters and we discuss it further in this article.

If you need fintech mobile app development for iOS and Android, the average salary of iOS and Android developers in the United States is $97K-98K, according to Glassdoor. In Ukraine, iOS and Android developers earn $25K-$40K.

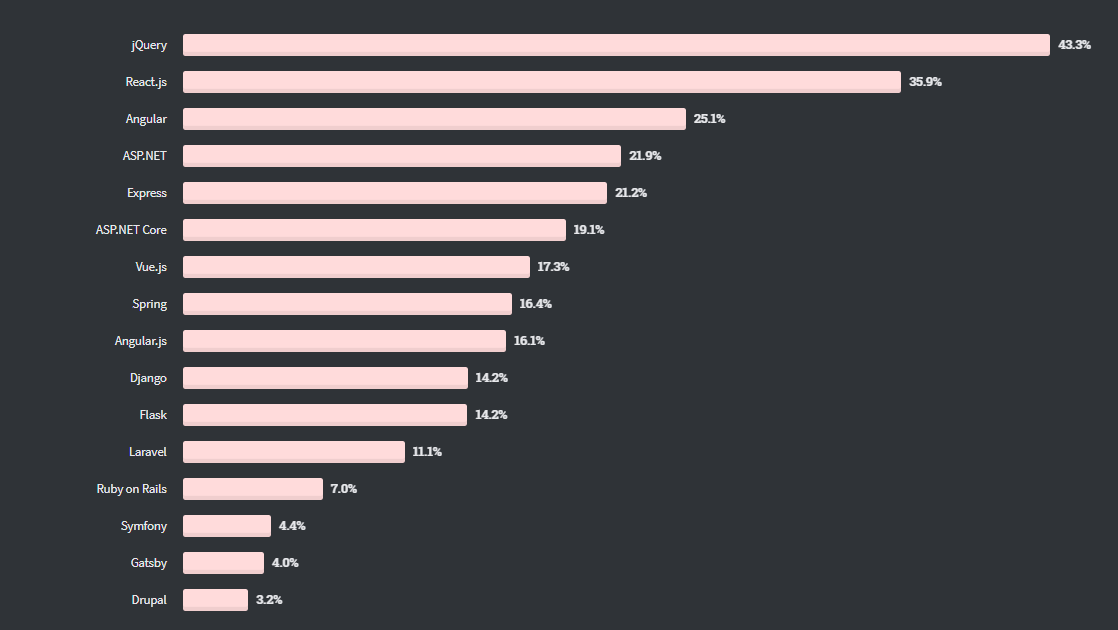

Among the most used frameworks are jQuery, React.js, Node.js Angular, Vue.js, and others.

Source: insights.stackoverflow.com

While deciding on your technology stack, you should take into account the project’s functional and non-functional requirements. Technologies should be selected individually depending on your project needs. If you don’t know which technology stack you should use for fintech app development, discuss it with your software development partner.

As a rule, a development company can provide you with tech stack recommendations. Here at MindK, for example, we give our clients suggestions on which technology best suits the project. Sometimes we provide several options and communicate the pros and cons of each option directly with the client.

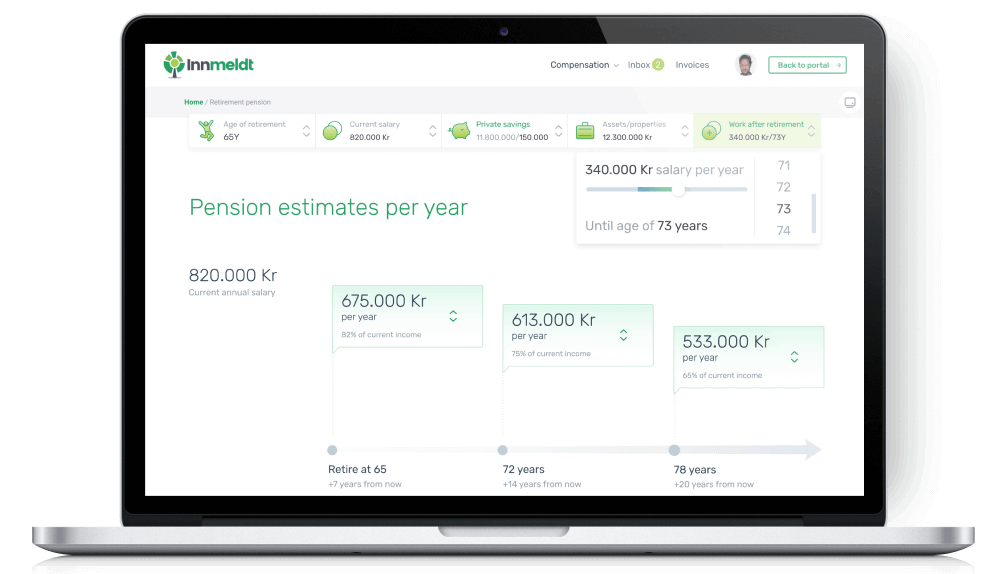

Let’s take for example our InsurTech project (which is a sub-type of FinTech apps) focused on automating pension and insurance calculations for the Norwegian market. We worked out an effective technology stack that covered all the project requirements from interactive user experience to complex integration:

- Ember.js for front-end development;

- Node.js for API development and integrations with third-party insurance systems;

- Symfony (PHP framework) for web portal back-end;

- PostgreSQL as a database; and

- Docker for better DevOps infrastructure.

Check out what functionality this technology stack helped us to cover

Key takeaway: the choice of the technology stack for your FinTech product has a great impact on the quality of the end product and its scalability in the future because all technologies serve different projects in unique ways. This is exactly why you should choose the technology stack before development begins to reduce risks and understand the budget.

#3. WHO (software development team)

The choice of a software development company you entrust to create your FinTech app is one of the most important variables that affect the final costs of the project. We’ve already given some tips on how to find a trusted outsourcing partner, so check out our article about steps to make your FinTech development outsourcing experience brilliant.

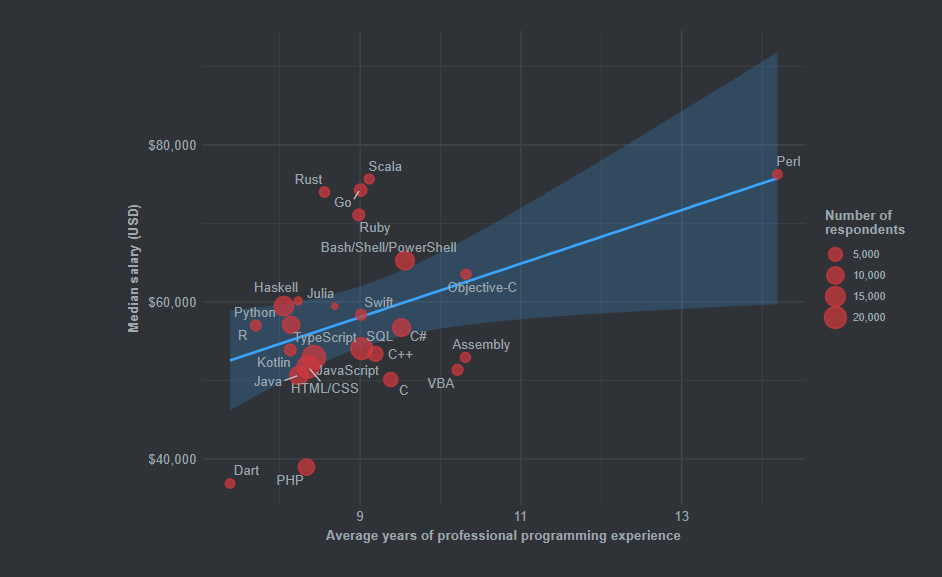

As a rule, the more the company pays its employees, the higher the development costs. Hourly rates of FinTech app developers depend on geographical location, experience, company size, expertise, and reputation.

In spite of the fact that the COVID-19 pandemic has accelerated remote working and slightly blurred the differences in salaries based on location, the difference still exists. Normally, software developers living in countries with a higher cost of living tend to have higher salaries.

Previously in this article, we already discussed the contrast between average developer salaries in the world and in the USA. And the statistics prove that an average annual salary (without reference to technology) differs depending on region.

Source: bridgeteams.com

From this perspective, in order to kill two birds with one stone, or hire a talented software development company and save costs, pay attention to regions with lower rates, for example, Eastern Europe.

Apart from the lower rates, Eastern European countries are famous for their exceptional quality of IT services and fewer cultural differences when compared with Africa and Asia Pacific regions.

Coursera’s Global Skills Index 2020 states that such countries as Belarus, Ukraine, Czech Republic, Poland, and Hungary are among the world’s top in the technology categories including software engineering, databases, security engineering, computer networking, and human-computer interactions. The research and development (R&D) office of MindK is located in Ukraine.

Take into account that the development cost also depends on the Seniority level of your development team members. In most cases, the relationship between the rates and years of coding experience is linear.

Source: insights.stackoverflow.com

Key takeaway: the choice of the FinTech software development company has a major impact on the cost, so, if you want to cut back on spending, try to find an experienced development company in a region with lower rates and build long-lasting cooperation.

#4. HOW (development approach)

The approach to developing Fintech solutions is no less important in terms of cost as the technology stack and choice of the development company. When we say development approach here, we mean two main things: engagement model and software development methodology.

Among a number of development methodologies, the most popular ones are Agile and Waterfall. If you dealt with software development before, you likely know the difference. If not, then check out our article about the difference between Agile and Waterfall.

In short, the Waterfall approach presupposes dividing the processes into phases including discovery, design, coding, testing, deployment, and maintenance. Each of the phases cannot start before the previous one is 100% complete. In this case, to see the result or make improvements you need to wait until all the stages are over.

Agile, on the contrary, divides the process into several parts (called iterations). All phases run in parallel, so the result of each iteration is an intermediate version of the product that offers value to end-users.

Agile is used to build a Minimum Viable Product with a set of basic features, then improve it based on the feedback. By the way, we believe MVP is the only right approach to start a project from scratch today and explain why in our article on MVP importance.

Difference between Agile and Waterfall

Image source:blog.usejournal.com

If you’re beginning to think that we’ve gone off topic and wonder what connection these approaches have to the cost of FinTech app development, the answer is – methodology has a direct impact on the final cost.

With Waterfall, you have no possibility to change requirements, scale up or down the project scope, and thus, adjust the budget on the go. Changes and improvements in this case, are usually the reasons for budget overruns. Agile allows reacting quickly to any changes in requirements and making adjustments at a lower cost during the development process.

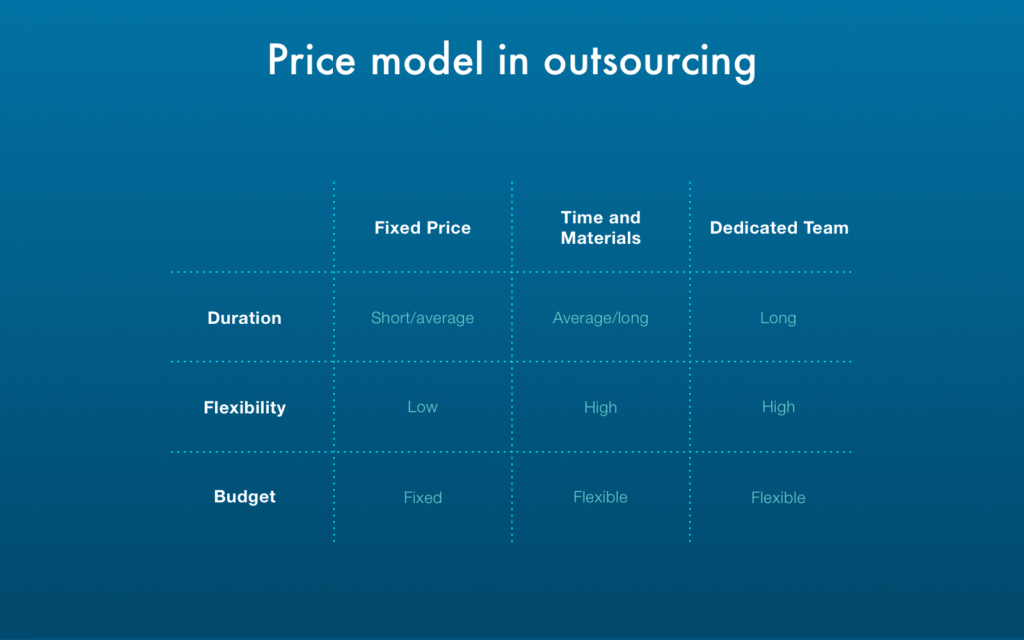

Another factor here that has a direct impact on the cost is an engagement model (also called a pricing model). We’ve reviewed their major types when talking about the differences of engagement models.

As a brief summary, the most popular pricing models include:

- Fixed price when the development company estimates the project and provides a fixed price for its implementation before the project begins.

- Time and Materials when the client pays for the actual hours of work of the external team.

- Dedicated team when the company provides specialists with the required expertise (the cost of the dedicated team consists of the combined salary of all team members).

Source: outsourcingreview.org

While Time and Materials and Dedicated team are quite flexible engagement models, with fixed price the costs of a man-hour may be up to 1,5 – 2 times more. As the development company usually shoulders the risk management in its entirety, all risks are calculated in advance and included in the bill. That’s why fixed-price are considered the most expensive of the engagement models.

Key takeaway: It’s wrong to think that the development methodology and the engagement model have nothing to do with the final cost. Fixed price contracts as well as following Waterfall methodology can increase the costs of development, while non-fixed price Agile projects help to cut down expenses.

#5. FOR HOW LONG (timeframes)

The last but not least factor is deadlines. The cost of development is greatly affected by the time limits imposed on the development team. Urgency almost always means a higher price. This is because to meet tight deadlines, the company has to allocate more resources.

A tight schedule as well as adding additional resources also comes with higher risks and requires more effective management. This is because the need for internal communication increases and the team becomes much harder to manage.

Key takeaway: tight deadlines cause the costs of development to go up, while non-urgent time limits help to keep the costs down.

How do we estimate the FinTech software development cost at MindK?

Now you have a complete picture of which factors influence the cost and make the estimation so hard to do, let’s see what to expect from tech development companies when you ask about the cost of your financial app.

Here at MindK we tried and tested a number of estimation frameworks and came up with a simple but reliable two-step approach: rough and detailed project estimates.

If you want us to put a price tag on the FinTech product you want to develop, we’ll gladly send you a rough estimate. It is a document that gives you a general idea about the costs of your project.

A typical rough estimation we provide at MindK consists of five sections: the estimate itself, our assumptions, our suggestions, the limitations, and our questions.

A detailed estimate is a much more extensive document, so before it’s produced, we have to gather and document all the requirements and clarify all the open questions. In rough estimates, we divide the app features into huge blocks called epics, in detailed estimates, we break each epic into features.

In the fixed-price projects, we make a detailed estimate after the Discovery phase which is usually billed as a separate project. However, detailed estimates don’t suit Agile projects, as

in most cases, it is difficult to predict the shape your app will take months and years down the road.

That’s why for Agile projects we prefer to use what we call Guesstimate which involves preparing approximate estimates without wasting a ton of time on the discovery phase.

As you can see, estimating the cost of the application involves a number of variables that prevent software development companies from providing exact cost from the very start. The only way to get the ball rolling is to start negotiations and share your software requirements.

So, share your FinTech app idea in the contact form and a MindK expert will get back to you with project estimates.