Insurance is one of the last things that come to mind when people think about cutting-edge tech. Most insurers still cling to outdated practices and business models. Yet, the industry is going through a quiet revolution. For insurance digital transformation is already here.

Research from McKinsey shows that insurance companies with advanced IT capabilities have a clear edge over competitors in cost ratios and agility. Digital leaders show 4x the growth above the industry average. And that are just some of the benefits of digital transformation in insurance.

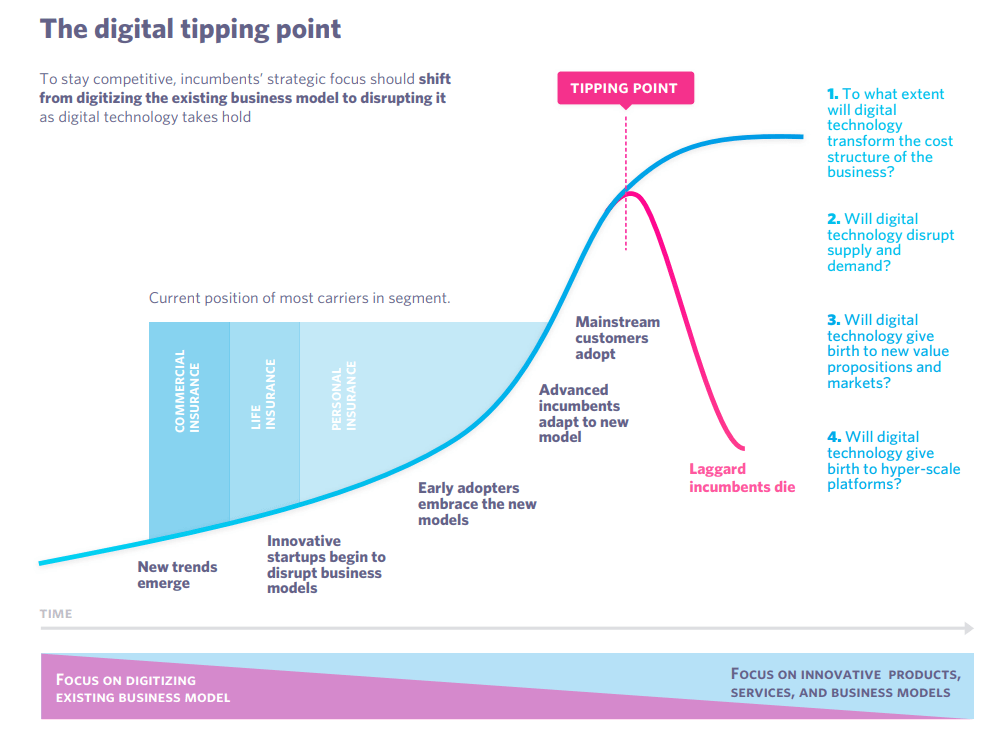

InsureTech is quickly becoming one of the fastest-growing FinTech sectors, expanding at a huge rate of over 34% a year. Investor buzz about insurance startups presents a huge threat to incumbents. Although most newcomers are building niche products, their innovation is rapidly changing customer expectations. Insurers too slow to adapt will face rapidly decreasing market shares.

Innmeldt was one such company. It operates in Norway, which has one of the most complicated pension and insurance systems in the world. Together with MindK, the company managed to digitalize all processes, creating an entirely new customer experience in the form of a SaaS app. Today, we’ll share their experience in digital transformation, together with insights from the world’s top analysts at Gartner, McKinsey, and Accenture.

Table of contents:

- Key insurance digital transformation trends that will shape the industry in 2023

- Business model #1: focus on customer relations

- Business model #2: provide value-added services

- Business model #3: develop insurance-as-a-service

- Business model #4: build an insurance ecosystem

- Practical steps to start your insurance digital transformation

Key insurance digital transformation trends that will shape the industry in 2025

The pandemic has shown just how radically customer demands can change in a relatively short time frame. Researchers at McKinsey outline five insurance digital transformation trends that will shape the industry by 2030:

1. Customer needs have changed significantly. People are getting used to fully digital experiences in other niches, instant service, and 24/7 access. This change represents a top concern for over 60% of insurers in a recent Gartner survey. Although most incumbents don’t fear new InsureTechs, these startups are creating unrealistic expectations for the whole industry. Insurers that fail to reach this high bar will face rising churn, falling sales, and Net Promoter Scores.

To stay competitive, insurers have to create omnichannel experiences that align with customer needs. They’ll need to provide simplicity, quick delivery, and access around the clock. In the near term, the insurance industry transformation will reduce expenses. Better experience will also lead to higher retention and profits, creating opportunities for new revenue streams.

2. Old business models are becoming irrelevant. Traditional insurers face rising pressure on cost and falling profits. The gap between the leaders and stragglers continues to grow, according to research from McKinsey. The life insurance sector, for example, shows 3x higher cost ratios in the bottom 25% of companies than in the top 25% of players. A key reason for this difference is the economy of scale. During the pandemic, we saw increased use of technology and automation in claims and policy handling. This led to significant market consolidation. For instance, Germany experienced a 25% growth in the market share of its top 5 insurance firms over the decade.

3. Regulators are starting to punish data breaches. The EU is currently investigating a large number of incidents in the banking sector that happened because of poor compliance and tech shortcomings. Many of these breaches have already eroded customer trust, destroying the bank’s position in the market. Regulators are likely to apply a similar approach to insurance firms. In fact, they have already drafted the legal base in the form of the Digital Operational Resilience Act and European Insurance and Occupational Pensions Authority guidelines for information and communication technology.

4. Insurers feel pressure from tech giants. There’s always a threat of outside players using their superior technology to disrupt a new industry. Take, for example, Amazon, which recently launched a digital insurance product for small and medium businesses. Tech giants can gather huge amounts of data from mobile phones, fitness trackers, home appliances, and other IoT devices. They have the tech to analyze this data to better serve their customers with targeted offers. Tech giants also have strong branding power, established customer relationships, and partnerships with other companies.

5. Sustainability is making its way to insurance. The sector will play a crucial role in building climate resilience against hurricanes, wildfires, flooding, and other extreme events. According to McKinsey, sustainability is shaping up to gain a competitive edge for insurers that can work with Environmental, Social, and Governance (ESG) factors. If you’re interested in this topic, I’d recommend reading an article about Energy Management that is based on our experience with building ESG software.

These trends will drive digitalization in the insurance industry in the next decade. Adapting to this new reality will, however, require insurers to rethink all aspects of their companies, including technology, processes, and people. We already see 4 emerging business models that will secure a profitable niche in the insurance market. Here’s what you should know about them.

Business model #1: focus on customer relations

Examples: Geico, Allianz, Fetch by The Dodo.

Requirements: niche expertise, high operational agility and efficiency, well-developed distribution channels.

This is the most traditional business model on the list. It focuses on excellent customer service in a specialized niche. An on-point example here would be Fetch by The Dodo – a pet insurance company acquired by Warburg Pincus in 2019. At the time, the insurer served more than 250,000 pet owners in the US and had almost $150M in profits.

Other players in this niche are legacy companies like Geico and Allianz that are investing heavily in digital transformation. By improving their agility and IT capabilities, such insurers can successfully leverage economies of scale and develop distribution channels.

Fetch app. Source: App Store

Business model #2: provide value-added services

Examples: Cognizant, Guidewire, Syncier.

Requirements: innovative tech, niche expertise, or excellent service.

Companies using this model – InsureTechs, incumbents, and IT companies – are building products or providing services for other insurers.

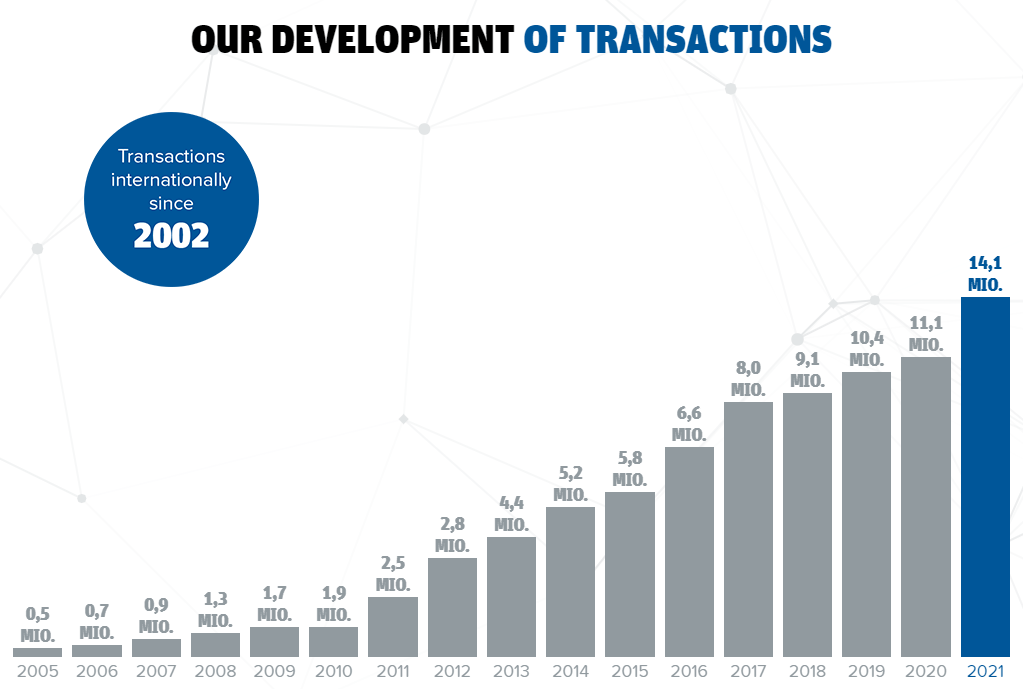

Take, for example, ControlExpert – a German company that automates claim management for car insurers. It uses Artificial Intelligence (AI) and input from industry experts to cut the time for settling a claim from several weeks to just a few hours. This highlights the growing role of Artificial intelligence in car insurance, enabling companies to optimize processes and improve customer experiences.

ControlExpert works with major insurers, car dealerships, and car manufacturers. In November 2020, it was acquired by Alianaz X for an undisclosed sum.

Source:EasyClaim

Business model #3: develop insurance-as-a-service

Examples: Neodigital, Phoenix Group, iptiQ.

Requirements: niche expertise or highly efficient economy of scale.

You can focus on building a digital product while leaving distribution and customer service to your partners. One example is Bancassurance – a form of partnership that allows insurers to sell their services via a bank. In this case, an insurance company will handle the product development, IT, operations, and most of the risks.

Insurance-as-a-service is an emerging field driven by tech-savvy companies. Some of them are building products for other insurers, promising to take care of a single process like fraud protection or underwriting via an Application Programming Interface (API) on a subscription basis. Other insurers like Phoenix Group have partnered with IT companies to digitalize processes and package them in a convenient SaaS product.

Innmeldt used a mix of both approaches. They used to consult with individuals about insurance and pensions in Norway. The company decided to combine its deep expertise in a narrow niche with the technological prowess of MindK to adopt a B2B2C business model. Together, we created a SaaS app that automates all insurance and pension calculations. Instead of working with individuals, Innmeldt can now sign contracts with companies that have thousands of employees. With a monthly subscription, they get access to a customized self-services portal for determining corporate benefits, insurance claims, and pension savings. Innmeldt subsequently increased its revenues while its clients attracted top talent with superior perks.

So if you want to explore this business model, I recommend checking our guides on building great SaaS products and the technical side of SaaS development.

Turning old-school pension insurance into a profitable SaaS business [read the case study]

Business model #4: build an insurance ecosystem

Examples: Pulse, Discovery, and Ping An Insurance.

Requirements: strong tech capacity and the ability to form partnerships with other companies.

Apple products are great. But their biggest strength is how well they create a closed ecosystem. A person owning an iPhone is much more likely to buy a new MacBook or Apple Watch. The same is true for Tesla. Unlike traditional automakers, the company owns both the production lines, repair stations, proprietary software, and the world’s largest network of charging stations.

In 2019, the company started to offer auto insurance. Tesla collects a ton of driving data to assess the risks and personalize offers, promising cost savings of up to 60% based on the driver’s safety score. While traditional insurers remain skeptical, Elon Musk thinks that his insurance business could reach up to 40% of Tesla’s $735B value.

We already see the rise of digital platforms and ecosystems that bundle insurance together with other services or goods. Insurers that find their place in this environment – as creators or enablers of ecosystems – will capture a huge market share while their competitors suffer from dwindling sales.

For example, Discovery – a major health insurance provider from South Africa. The company developed a strong core technology that delivers hyper-personalized insurance plans based on behavioral data and used this tech to create a digital platform for other insurers. As more companies join the ecosystem, Discovery gains access to other markets and segments, attracts new customers, and gathers more data to improve services.

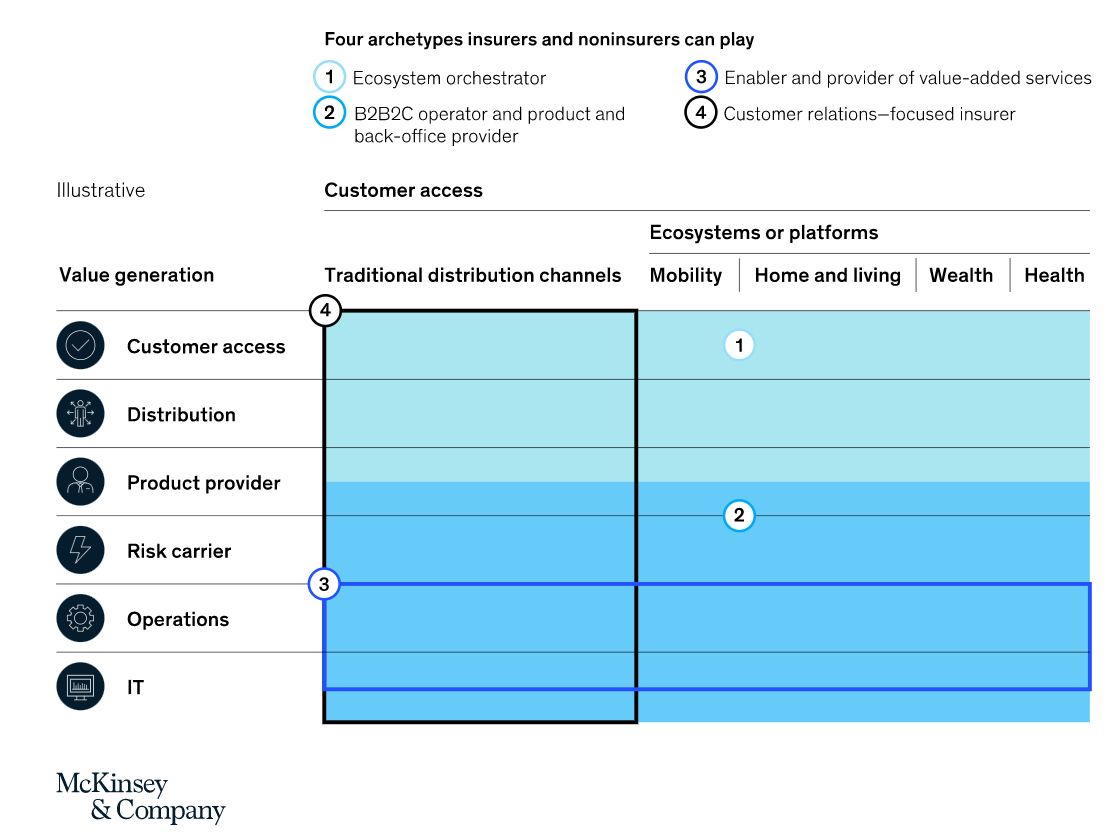

The last two business models have, perhaps, the highest potential for expansion. McKinsey estimates that by the end of the decade, they will grow by 70%, reaching over €40B in value. Most of this growth will result from technology, IT operations, and support.

Enterprise-scale insurers will have an easier way to utilize their size and talent advantages in the B2B2C niche. Small and medium-sized companies will have a harder time identifying the strengths that can give them an edge in the digital insurance market. One way forward is to partner with larger peers as producers or enablers of their B2B2C offerings. Smaller insurers can also compensate for their smaller size and talent pool by working with IT companies that specialize in financial software.

Practical steps to start your insurance digital transformation

Most insurers now realize they need to act quickly. Yet, relatively few understand how exactly to make the journey into unexplored territory. We can, however, take some lessons from the early adopters and successful transformations in other niches.

Accenture report concludes that technology in the insurance industry should go hand-in-hand with business strategies. Insurers should assess their current processes, skills, organizational structures, and partnerships. At this point, digital transformation consulting can be a great way to identify your strengths and weaknesses before starting your journey.

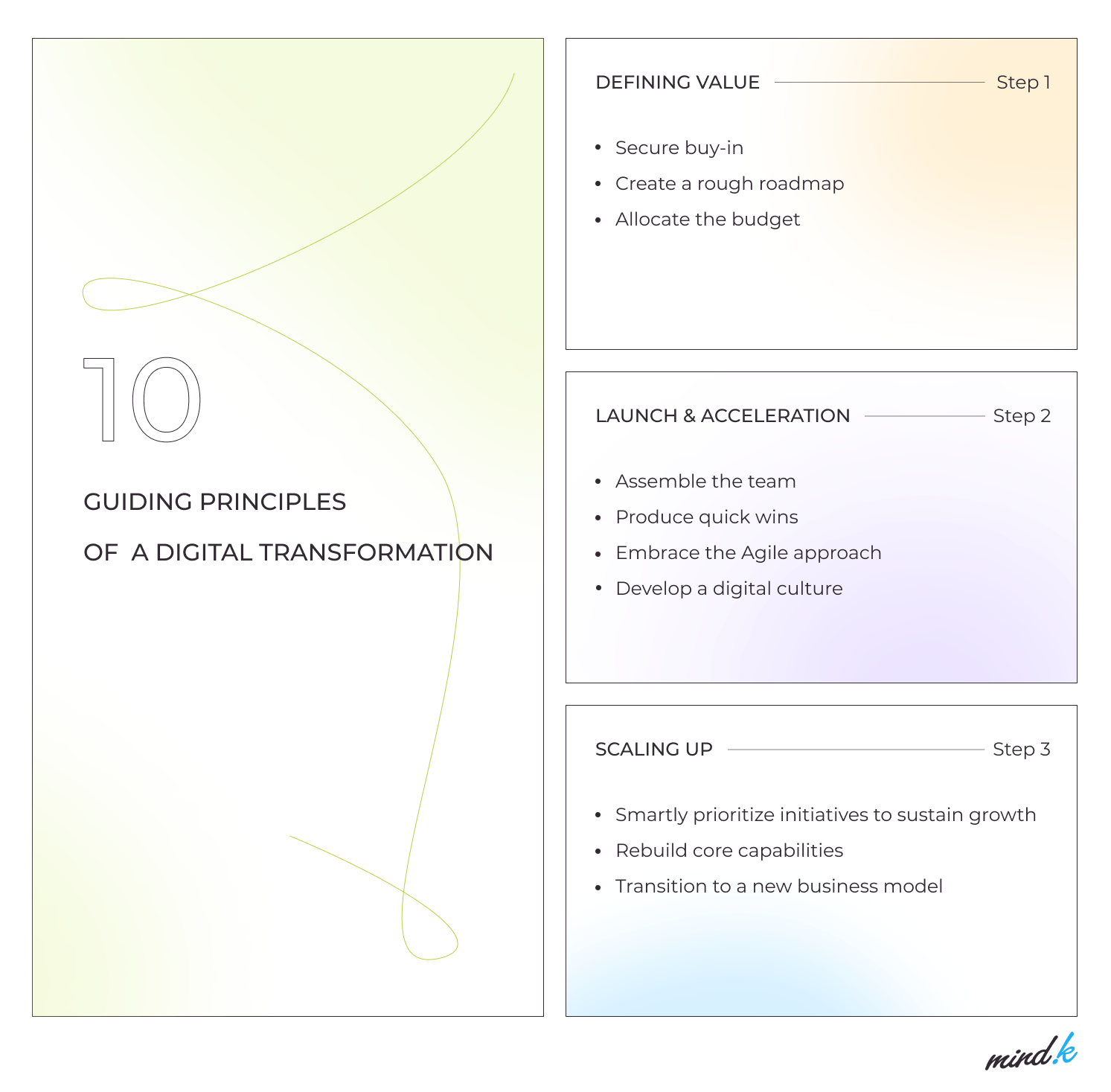

According to McKinsey, digital transformation for insurance companies will usually consist of 10 steps:

1. Secure buy-in

A CEO should be fully on board with digital transformation efforts or they’ll be dead on arrival. His or her vision will drive the entire team, proving that technology is a key priority for the company.

2. Create a digital roadmap

A strategic roadmap is a document that sets the direction for your transformation journey. It outlines clear long-term goals, prioritizes high-value initiatives, and defines the success metrics for the team. All of these elements should be updated regularly as the industry keeps evolving.

3. Allocate the budget

According to McKinsey, insurers with legacy systems must increase their IT spending twofold over the next five years. Incumbents will have to allocate money both to application modernization and building new capabilities. In the near future, the increased budgets will come from decreased profits, however, this will significantly reduce long-term risks for the company.

4. Assemble the team

Insurers will need to seek talent that might be scarce in the industry – design thinkers, experienced engineers, Scrum masters, data scientists, and Machine Learning specialists. According to McKinsey, a company with $5 billion worth of premiums will be looking at adding 20-100 new employees in the first 1.5 years of digitalization. Hiring, training, and retaining qualified engineers should become the top priority for insurers. You can kickstart this process by hiring a known expert to attract other specialists or acquiring an InsureTech startup. At the same time, smaller companies can access a wider talent pool by developing near- and offshoring strategies.

5. Produce quick wins

Early on, you can’t take support for granted. So it’s important to prioritize projects that could provide quick wins with moderate risks.

You can start with redesigning your customer journey to provide a seamless digital experience. Building a small Minimum Viable Product will allow you to test all your assumptions with real users while decreasing the risks.

6. Embrace the Agile approach

The talent you acquire will need to be organized in new ways. Industry leaders have already adopted the product-centric philosophy. Such insurers employ independent Agile teams that have all the necessary skills to deliver new features and sell them via digital channels. A test and learn Agile approach aims to put a working product in customer hands to gather feedback as early as possible. Such teams persist after the release to support the product, gather feedback, and propose improvements until the company finds new priorities.

By using the Agile way, one large European insurer managed to cut the number of management committees by 30% and improve operational efficiency by 20%. You can learn more about this approach by downloading our book on Agile development.

7. Develop a digital culture

This is a huge change for incumbents. They’ll have to build their priorities around customer needs rather than time-tested processes. “How will this generate value for the clients?” should become the starting point of all initiatives at the company. You can involve customers as early as possible, test often, collect feedback, and improve in quick iterations.

Most insurers still work in silos with little communication going between the business, development, IT operations, and QA teams. Adopting the DevOps culture will go a long way toward dissolving these barriers.

8. Smartly prioritize initiatives to sustain growth

1.5 years is typically a good timeframe to achieve some success in your transformation efforts. At this time, you’ll likely have several initiatives in the progress that deliver some value. Scaling at a reasonable pace is all about smart prioritization. So look for opportunities that are strategically valuable, give quick returns, and lead to simplicity. In most cases, this involves looking for cost-cutting measures instead of growth opportunities.

9. Rebuild core capabilities

Delivering a modern customer experience will require you to modernize the pillars of your business – policy administration, billing, and claims mechanisms. This requires both modernizing applications and continuously updating skills using internal training programs.

10. Transition to a new business model

At some point, you will get ready for a fundamental shake-up of your company’s operational models. It is high time to remove the organizational barriers, organize people around customer value in impermanent teams, and empower them to make decisions.

According to KPMG, digital leaders are already adopting a platform-based architecture that allows adding new modules and technologies without upsetting the entire system. They also engage in large-scale partnerships, leverage emerging technologies, and keep looking for new markets, revenue streams, and ways to generate additional value.

Conclusion

In 2023, insurance is on the verge of a massive shift. The players that are quick to recognize this will secure a leading position in the market. And those who are too slow to read the room will risk going out of business when more agile companies eat up their market shares.

When you work in insurance, digital transformation can be intimidating. Yet, everything is possible if you have the right combination of talent and expertise.

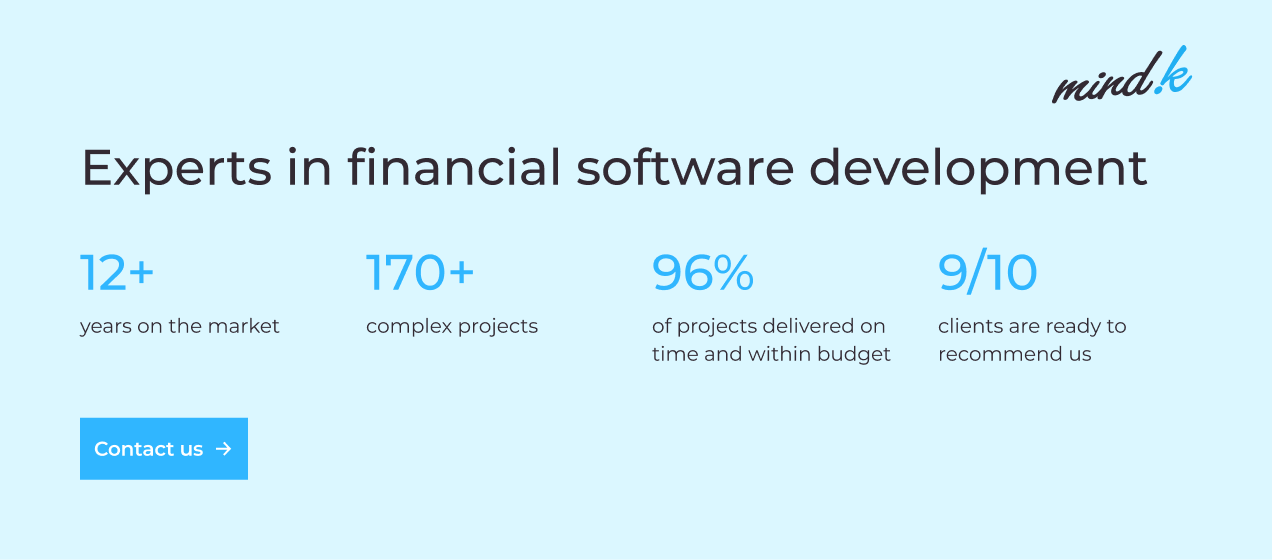

If you don’t know where to start, it might be a good idea to contact a company that specializes in digital transformation services. MindK has been working with the financial sector for more than 10 years. We’ll gladly provide you with both the advice and resources you need to develop cutting-edge insurance software. So, just drop us a line and we’ll arrange a free consultation with our experts.