Software as a Service (SaaS) continues to dominate how modern organizations buy and consume software. The sector is expected to grow from $375.57B to $1,482.44B by 2034 (18.7% CAGR). However, a lot of tried-and-true methods for SaaS product development no longer work in 2026.

This was quite a painful realization for the teams at MindK. As a SaaS development company, we had to change more processes in 2025 than over the past 15 years combined. But it was totally worth the effort. Across industries, SaaS vendors chase efficient growth, strong retention, and predictable economics. The modern landscape requires rapid validation, real-world learning, and delivery under increasingly lean budgets.

Almost 100% of newly founded SaaS companies are built around AI as the core feature, according to the 2025 SaaS Benchmarks Report. AI is embedded into core workflows, analytics, and user experiences. Many SaaS teams (including our own) now use AI agents and adaptive models to accelerate development and validate ideas without risky investments.

This evolution of SaaS product strategy matters because it changes how value is discovered, built, and measured. Early validation is powered by data, not guesswork. Metrics are tracked from day one to inform decisions instead of retroactively summarizing them. Scalability is designed into the architecture instead of being bolted on later.

In this updated guide, we walk you through 10 steps of SaaS product development, from validating your idea with real users on a shoestring budget to building an AI-aware product and scaling it with measurable business impact.

Table of contents:

- #1. Discover a problem worth solving

- #2. Find a competitive advantage

- #3. Map out the SaaS product vision and strategy

- #4. Validate the idea before going all in

- #5. Define an MVP that can measure what matters

- #6. Choose technical foundations with future growth in mind

- #7. Accelerate SaaS product development with AI

- #8. Test your pricing strategy early, refine often

- #9. Survive the launch

- #10. Let feedback guide your SaaS product development

#1. Discover a problem worth solving

The first step of the SaaS development process is to validate your core assumptions:

- Is this a real problem that customers are willing to pay to solve?

- What is the minimum outcome that proves value?

- Who will actually use the product and why?

The aim is not to build the full product yet, but to ensure the problem is worth solving and that your initial solution direction resonates with real market demand.

At MindK, we start product development with user interviews, competitive research, and clickable prototypes. These help uncover whether your idea addresses a pressing need, and allow teams to iterate on assumptions before significant investment. Over time, this approach prevents costly mistakes and aligns the product with what customers truly value.

Discovery also sets the stage for defining your MVP that balances minimalism with the capability to collect real data and meaningful feedback.

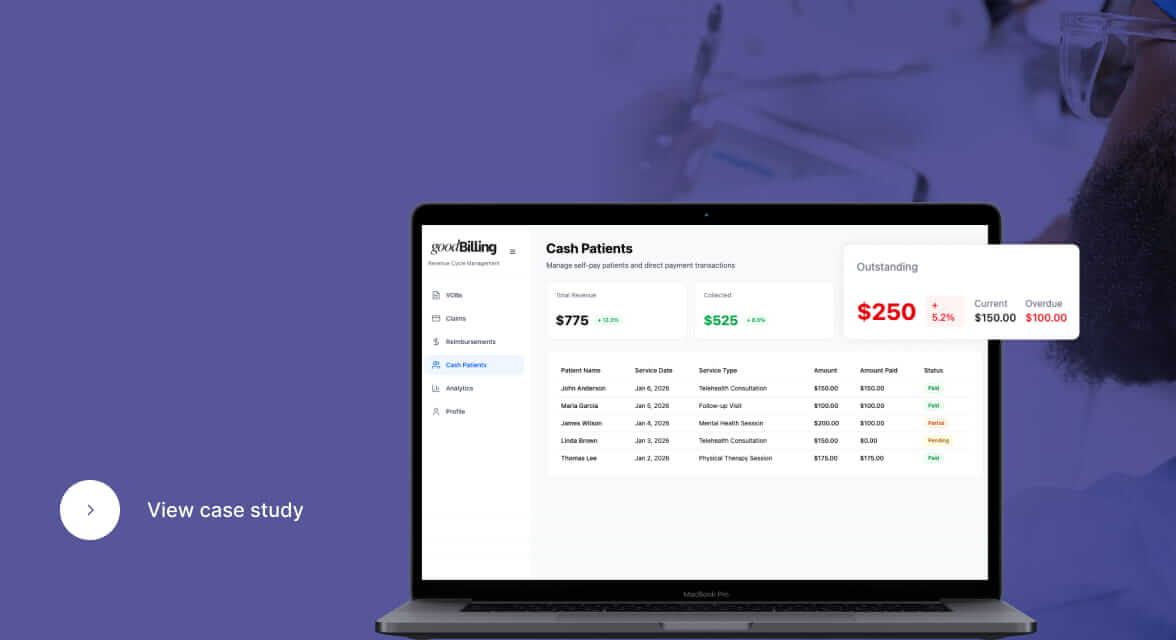

All the SaaS products we helped develop at MindK have such problems as their base. For example, GoodBilling is based on one of the most persistent pain points in healthcare. These include time-consuming, inconsistent workflows for eligibility checks, benefits verification, documentation, and claim creation.

The team and founders engaged with revenue cycle management (RCM) educators, providers, and administrators to understand the ins and outs of this challenge. Based on these validated insights, we designed and built an AI-powered solution to automate these workflows at scale. The first production version was delivered in five months, winning the first customers and proving the solution’s viability to investors.

GoodBilling, an end-to-end RCM platform that processes 68K claims a month with minimal human intervention [case study]

#2. Find a competitive advantage

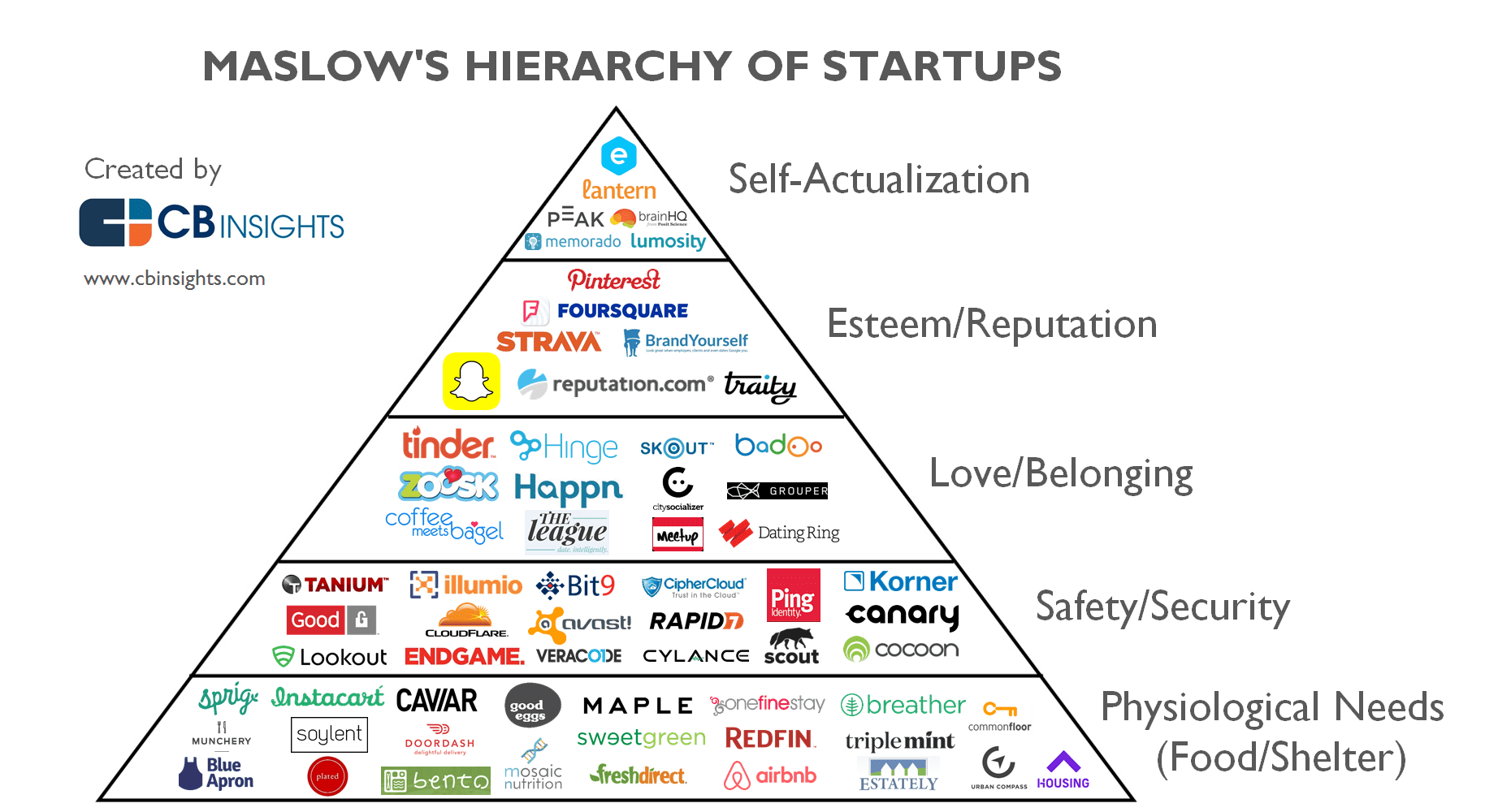

The SaaS landscape is populated by thousands of competing vendors, from specialized vertical platforms to horizontal enterprise systems. Over 1,300 startup unicorns alone illustrate the depth of competition in digital software sectors, which means differentiation must come from product-led growth, AI-enabled capabilities, or niche focus.

So, the next step after you understand what problem your SaaS platform will solve is competitor analysis: design, features, marketing and advertising, pricing, and more. This will help you understand how other companies have implemented similar ideas, what the target audience expects, and which features had a positive impact.

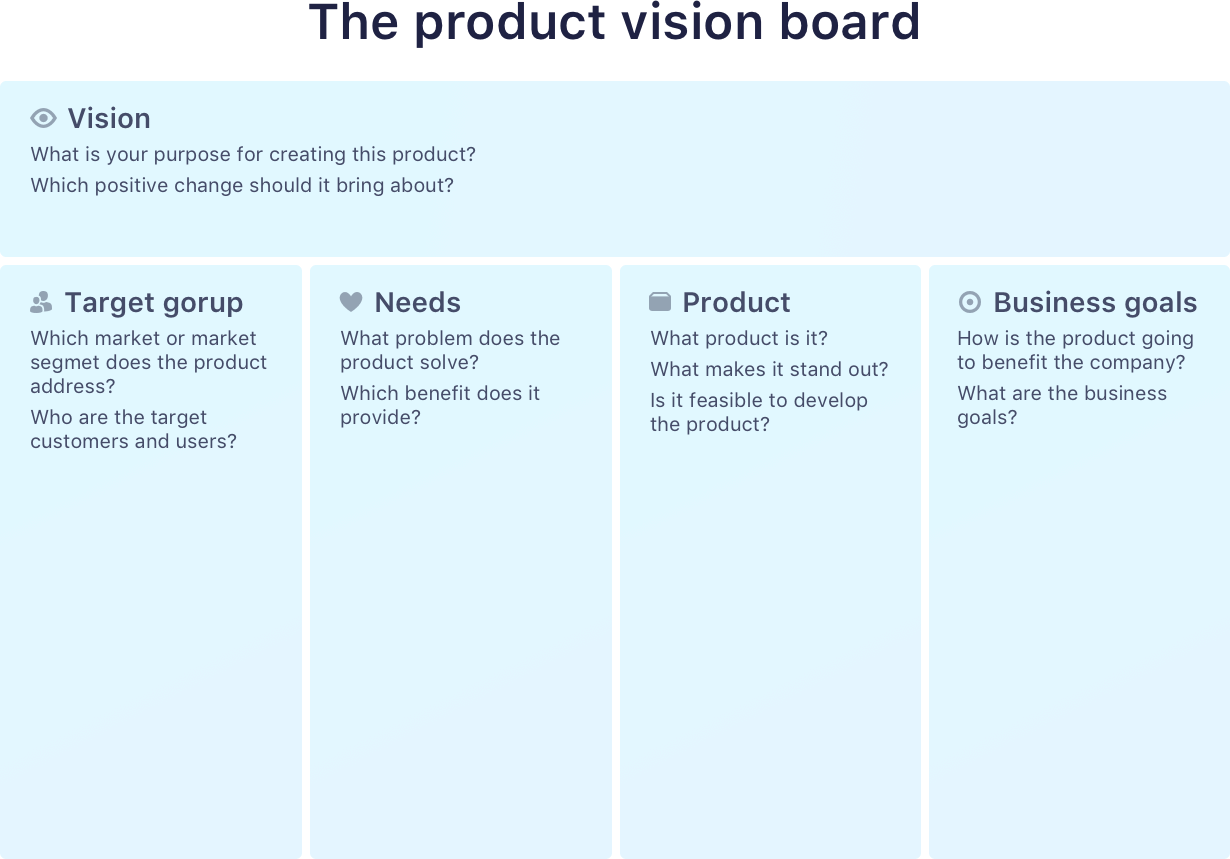

Even mature industries, filled with competition, have unexplored market niches and fresh opportunities for those who seek them. You can stand out from the crowd by:

- Adding specific features. Although the product itself may not change, you can absolutely improve it with new functionality. Even within a competitive industry, new product features may be sufficient to differentiate the product.

- Targeting other demographics. You can target a different demographic or leverage on customer preferences that major competitors might be neglecting.

- Playing with a price. If your competitors are providing a service at the same price, you can focus on their existing audience or target a new audience by offering a lower price. Or you might potentially tap into a premium market by charging higher prices, assuming you can offer a higher-quality product.

- Exploring new geographic locations. If you have a popular business, product, or service in one part of the country or world, you may introduce it to another part that is unfamiliar with it.

- Offering peripheral services. It is also feasible to differentiate yourself from the competition by providing services that competitors do not provide.

- Going niche. Launching a niche SaaS project like custom EHR software for lactation consultants is faster, cheaper, and less risky.

#3. Set product vision and strategy

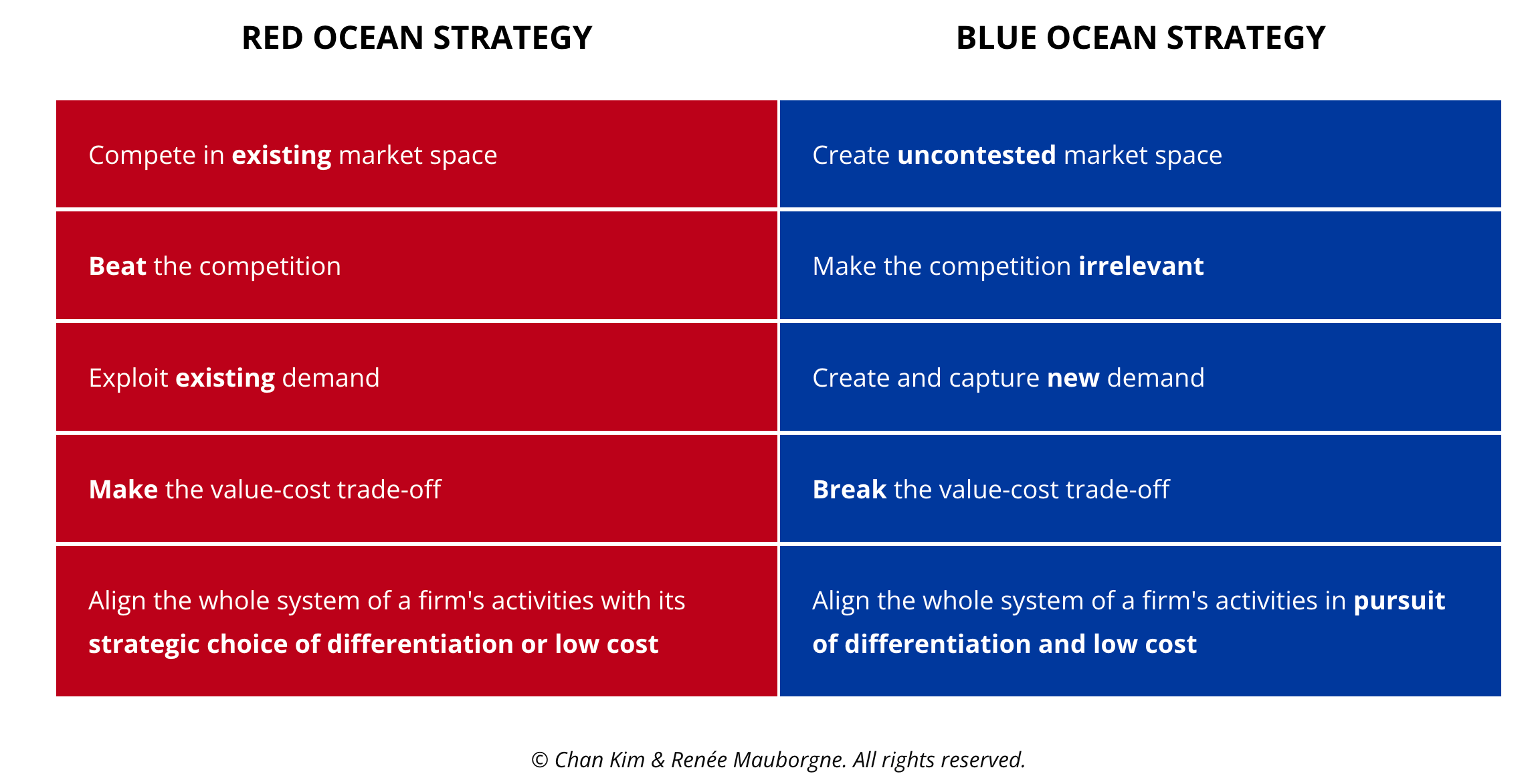

The product vision is the blueprint that describes the primary concept and elements of a product. In short, a product vision defines where you are going. The key goal is to communicate the vision and motivate the teams (and stakeholders, investors, partners, prospective customers) to contribute to making the vision a reality.

SaaS product strategy, in turn, defines how the product’s vision will be realized. That’s why the primary distinction between product vision and SaaS product development strategy is that product vision represents the future state for users that comes from the value the product provides, while product strategy refers to the collection of decisions you must make in order to accomplish the vision.

The product vision board is the most straightforward way to capture a vision and SaaS product strategy. It consists of five sections, where:

- Vision denotes the goal, the main reason for developing the product, and the positive changes you plan to achieve.

- Target group refers to the market or market segment the product plans to focus on.

- Needs show the product’s value proposition, which are the key pain points the product addresses, or the primary benefit it proposes.

- Product summarizes the three to five aspects that distinguish your product and are vital to its success.

- Business goals describe why it is advantageous for your organization to invest in the product. It specifies the expected business advantages, such as increased revenue, entry into a new market, cost savings, brand development, or acquiring useful information.

#4. Validate the idea before going all in

Market validation and discovery is the process of evaluating a product idea in real-world market conditions before any significant investment. Modern SaaS discovery includes:

- Market surveys.

- Opportunity sizing.

- Competitor benchmarking.

- Jobs-to-be-done interviews.

The goal is to test whether customers will actually pay for your solution before building anything substantial. However, it’s impossible to truly validate an idea without putting a working product into a user’s hands. Our teams at MindK find AI to be incredibly useful in generating interactive prototypes, proofs of concepts, or lightweight apps that allow A/B testing of multiple hypotheses faster than ever before.

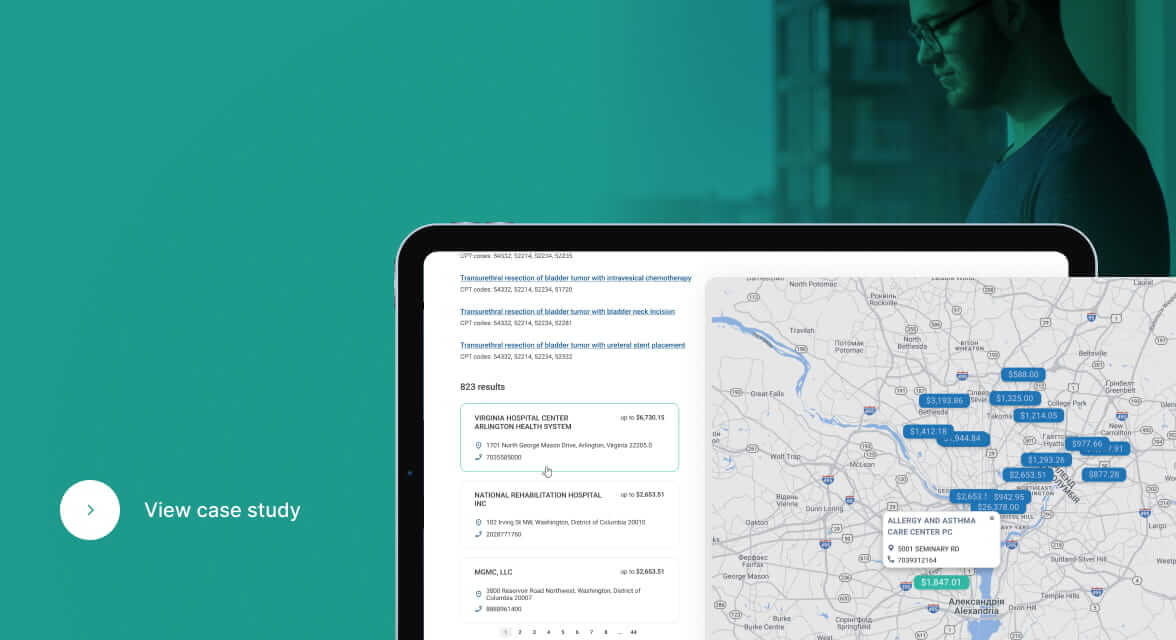

One of our clients noticed that healthcare price transparency became a requirement under federal rules. However, most insurers dump the required information in enormous MRF files. Early research and stakeholder discussions confirmed that this data was difficult to access and didn’t allow users to make meaningful cost comparisons.

To validate the problem before committing to full development, the team built small-scale AI prototypes and data ingestion pipelines. These early prototypes evolved into a cloud-native solution capable of visualizing 20+ terabytes of pricing data coupled with an ultra-fast search across all US states.

HLTH Rate, a pricing transparency solution that covers 250K+ providers [case study]

#5 Define an MVP to measure what matters

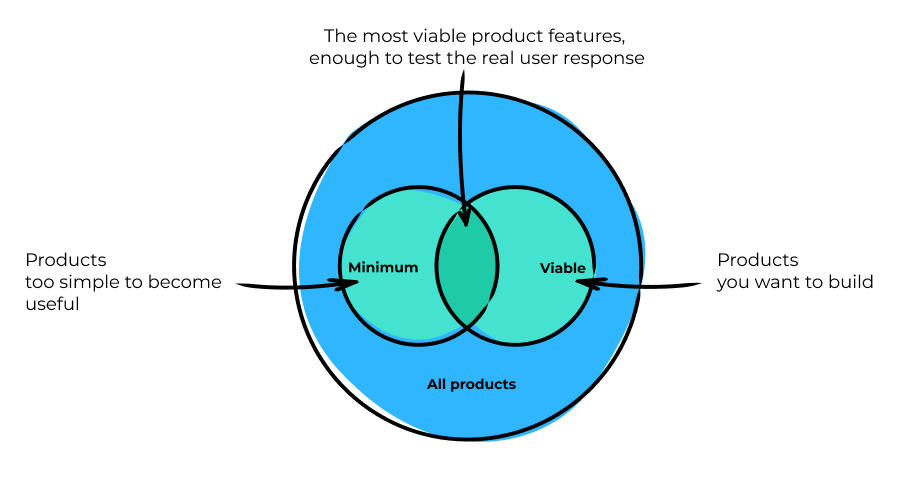

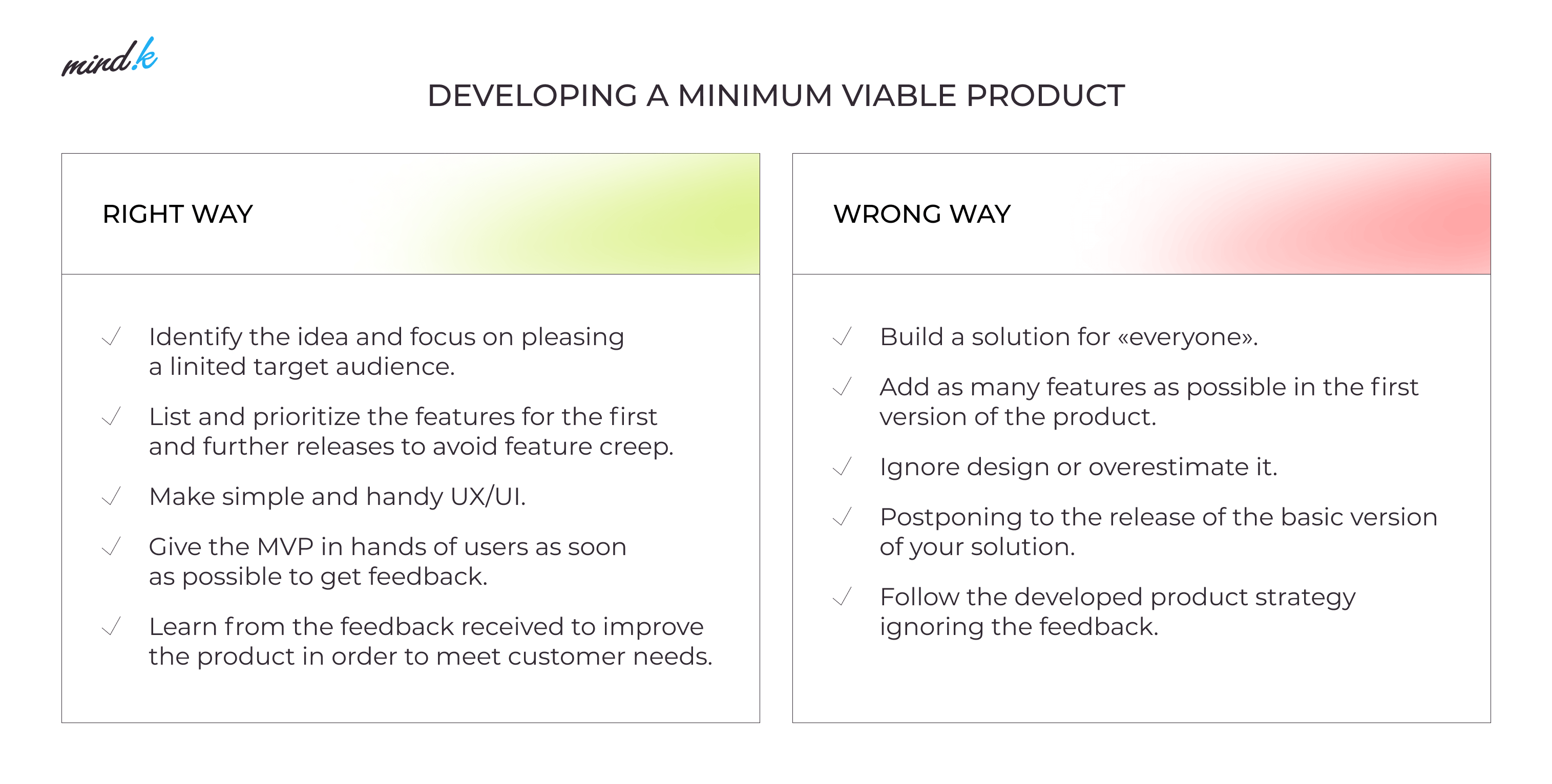

Now we need to translate the grand vision into the details needed for developing a minimum viable product. This MVP is the smallest version of a SaaS product that still creates measurable value for early users. The purpose is to prove core hypotheses and gather evidence about user behavior.

Don’t try to include as many features as possible in your first version. The MVP should have the smallest possible feature set that creates, gains, and reduces pains for customers. To get acquainted with the whole MVP development process, check our step-by-step guide on how to build an MVP from the ground up.

There are many ways to elicit requirements in SaaS product development. At MindK, we like user stories (as a < type of user >, I want < goal > so that < reason >) because they switch attention from writing requirements to talking about them. Here are a few other guidelines we follow to elicit requirements effectively:

- Keep the user in focus. A story shows the relationships between the user and the functionality of the product. If we have no clear understanding of who your customers are and why they should use your software, user stories become pure speculation.

- Leverage personas to empathize with specific user types.

- Start with epics, sketching out the rough scope, then add details with user stories.

- Fill up the acceptance criteria to and make the user story testable (on average, a user story has 3-5 acceptance criteria).

- Avoid any terms that might be perceived differently by SaaS developers and the client.

- Create all user stories together with the key stakeholders.

In practical terms, defining an MVP means prioritizing features or user stories that address your customers’ most pressing needs and tracking them from day one. For SaaS products, key measurements include:

- Activation. Are users experiencing the “aha moment” within the first session?

- Retention/Churn. What percentage of users continue month over month?

- Expansion Revenue. How much additional revenue comes from upgrades or increased usage?

- MRR/ARR Growth. Are recurring revenues trending up sustainably?

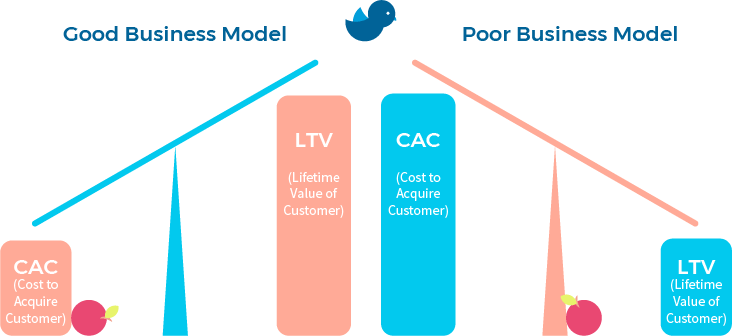

- Customer Acquisition Cost (CAC) Payback. How long does it take to recover acquisition costs?

Your MVP should be designed to collect enough real usage data to assess these metrics meaningfully. Long before you’re building for scale, you’re learning what customers value.

Most of our clients start their solutions with the MVP. One example is Bridge, a SaaS operating system for global hiring. In just three months, we built an MVP of the system that provides a full cycle of services needed to open and manage a remote office with no headaches. Now the platform is collecting feedback from potential customers and investors in order to further improve the solution.

#6. Choose technical foundations with future growth in mind

It’s now possible to build a quick proof of concept using low-code SaaS development tools or AI for 99% of the tasks. However, production-ready software must be capable of growing beyond the few initial customers and use cases. Most vibe-coded apps still can’t do this in 2026 (as well as be easy to maintain at low costs).

Future scaling is much smoother when built on a solid, modular architecture with observable performance and manageable infrastructure. For SaaS products, this typically means:

- Cloud-native deployment (e.g., AWS, Azure, GCP).

- Well-defined APIs and extensible services.

- 100% of infrastructure defined as code.

- Security and compliance designed from the outset.

- Scalable data storage and analytics.

If you’re interested in the nitty-gritty details, our guide on SaaS application development provides a much deeper dive into the technical foundations behind successful products.

#7 Accelerate SaaS product development with AI

Almost all SaaS companies launched in 2025 view AI as the product’s core capability. Practically, this means:

- AI-assisted coding and automated reviews are streamlining development cycles.

- Analytics that help teams discover MVP insights faster.

- Personalization engines built on AI improve engagement and reduce churn.

- AI for optimizing pricing, workflows, analytics, and customer experience layers.

At MindK, we’ve spent the past two years refining a SaaS outsourcing methodology that allows the client to save 20%-30% of the total cost of shipping a production-ready SaaS product. It follows the standard Scrum rhythm of short, iterative sprints, but with AI supporting the most time-consuming activities inside each iteration

Faster project initiation with production-grade foundations

At the start of delivery, AI assists engineers in generating Infrastructure-as-Code and CI/CD pipelines based on the agreed solution architecture. Instead of manually assembling cloud resources and deployment scripts, engineers use AI tools to produce Terraform modules, security configurations, and automated pipelines that follow proven architectural patterns from the first week of the project.

This reduces infrastructure setup time by about 30–40% and ensures that the SaaS application starts on a scalable, secure, and modular foundation that won’t need refactoring as the product grows.

Accelerated coding without sacrificing quality

Developers use context-aware AI tools connected to MindK’s internal code standards and reusable modules. Instead of writing boilerplate code, they focus on business logic and architectural decisions while AI generates structure, patterns, and repetitive components. This reduces coding time by 30–35% while keeping the code aligned with established best practices.

AI also assists with debugging by analyzing runtime logs and suggesting fixes based on the live environment, cutting the average time to resolve issues by nearly 50%.

Automated test coverage

As new features are developed, AI generates unit tests, integration tests, and data mocks that follow project testing standards. This ensures high code coverage early in the process and reduces the engineering effort spent on writing and maintaining test scaffolding.

Documentation alongside coding

Instead of writing technical documentation after development, AI generates API definitions, code comments, and architecture artifacts as features are implemented. Documentation remains synchronized with the codebase and eliminates the common “documentation debt” that slows future development and onboarding.

Before each release, AI translates acceptance criteria from user stories into executable test scenarios. Combined with AI-driven end-to-end testing tools, this allows the team to validate real user journeys across browsers and devices.

| Phase | AI-enabled timeline | Traditional timeline |

| Infrastructure & setup | 2–2.5 weeks | 3–4 weeks |

| Core development | 5–10 weeks | 8–14 weeks |

| Testing & launch prep | 1.5–2 weeks | 3–4 weeks |

| Total | 7.5–14.5 weeks | 14–22 weeks |

#8 Test your pricing strategy early, refine often

SaaS pricing strategy is a continuous experiment, not a one-off decision. Early such experiments should help the team understand:

- Will users pay for convenience, usage, outcomes, or a combination?

- How different pricing tiers affect conversion and churn

- Where value thresholds exist in the user base

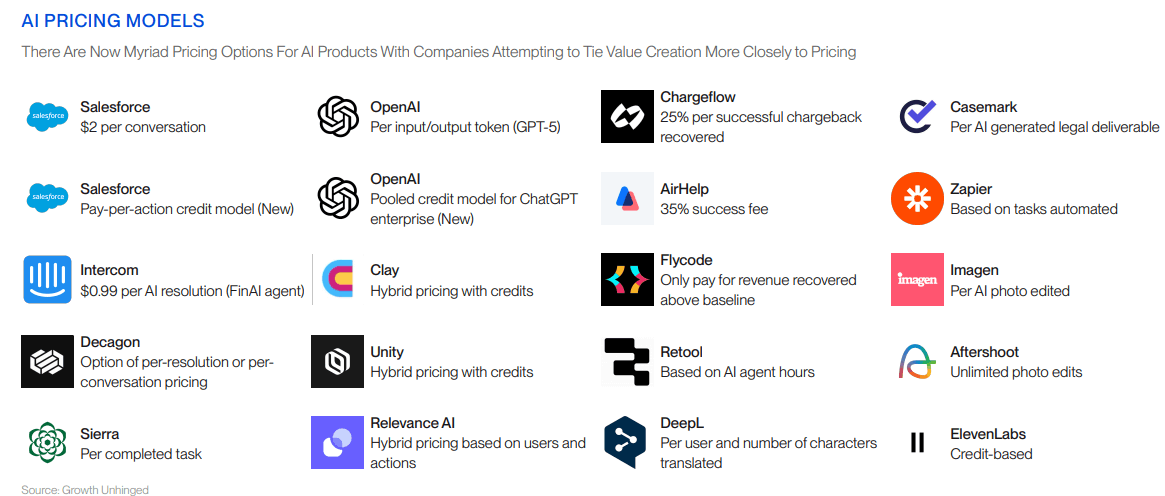

Successful pricing strategies differ a lot between industries and vertical niches. We’ve already discussed it while reviewing the revenue models that work in EdTech. However, most of the pricing strategies belong to the following categories:

Source: Growth Unhinged

Cost-based pricing

This type of pricing is based on the total cost of providing a service together with a relevant profit margin to generate a return on investment (ROI). It’s easy to calculate but usually ignores the additional business expenses, competitors, and so on.

| Metric | 25th percentile | Median | 75th percentile |

| Software Gross Margin | |||

| <$1M ARR | 64% | 75% | 80% |

| $1-5M ARR | 60% | 77% | 85% |

| $5-20M ARR | 70% | 80% | 86% |

| $20-50M ARR | 71% | 78% | 84% |

| >$50M ARR | 70% | 79% | 83% |

Data source: 2025 SaaS Benchmarks Report

Value-based pricing

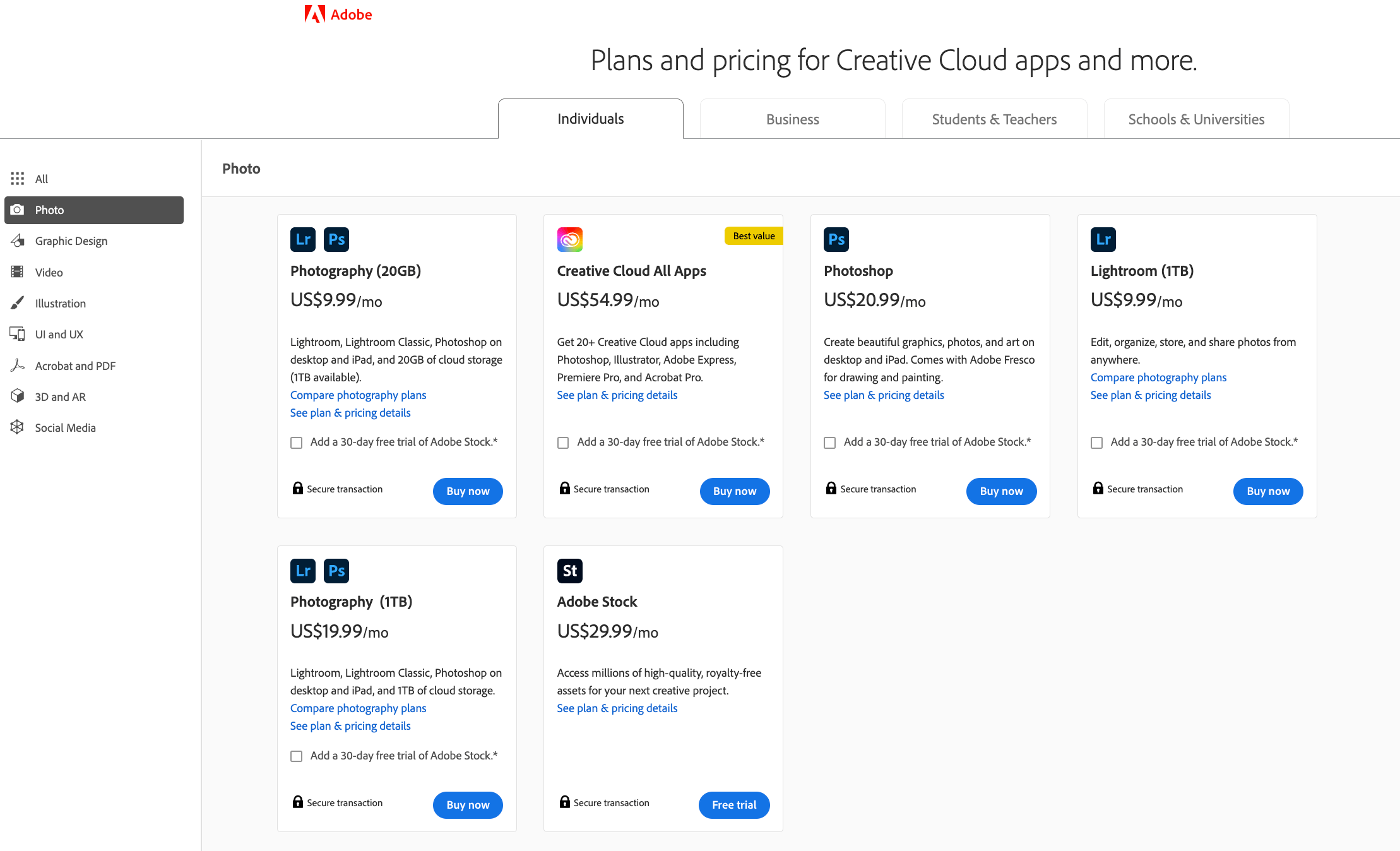

Unlike cost-based pricing, value-based pricing assumes that customers are willing to pay a higher price for a product that’s genuinely useful. For example, this pricing strategy is well-used by Adobe. Although the product is pricier than competitor alternatives, clients realize the extra value and remain loyal to the company.

Source: adobe.com

Usage-based pricing

Modern SaaS offerings increasingly embrace usage-based pricing, with ~44% adoption to align cost with customer consumption, boost conversion, and lower churn.

AWS is an example of a product that uses this strategy to great effect. Users only pay for the computing time or power they use, and have access to everything regardless of their tier. Usage-based models also drive ~31% more annual revenue growth, demonstrating that flexibility in pricing is a competitive advantage.

| Metric | 25th percentile | Median | 75th percentile |

| Growth Rate (YoY) | |||

| Subscription | 10% | 25% | 50% |

| Usage-based | 31% | 44% | 80% |

| Subscription + usage-based | 17% | 26% | 42% |

| Net Revenue Retention Rate | |||

| Subscription | 94% | 101% | 108% |

| Usage-based | 99% | 101% | 110% |

| Subscription + usage-based | 99% | 110% | 117% |

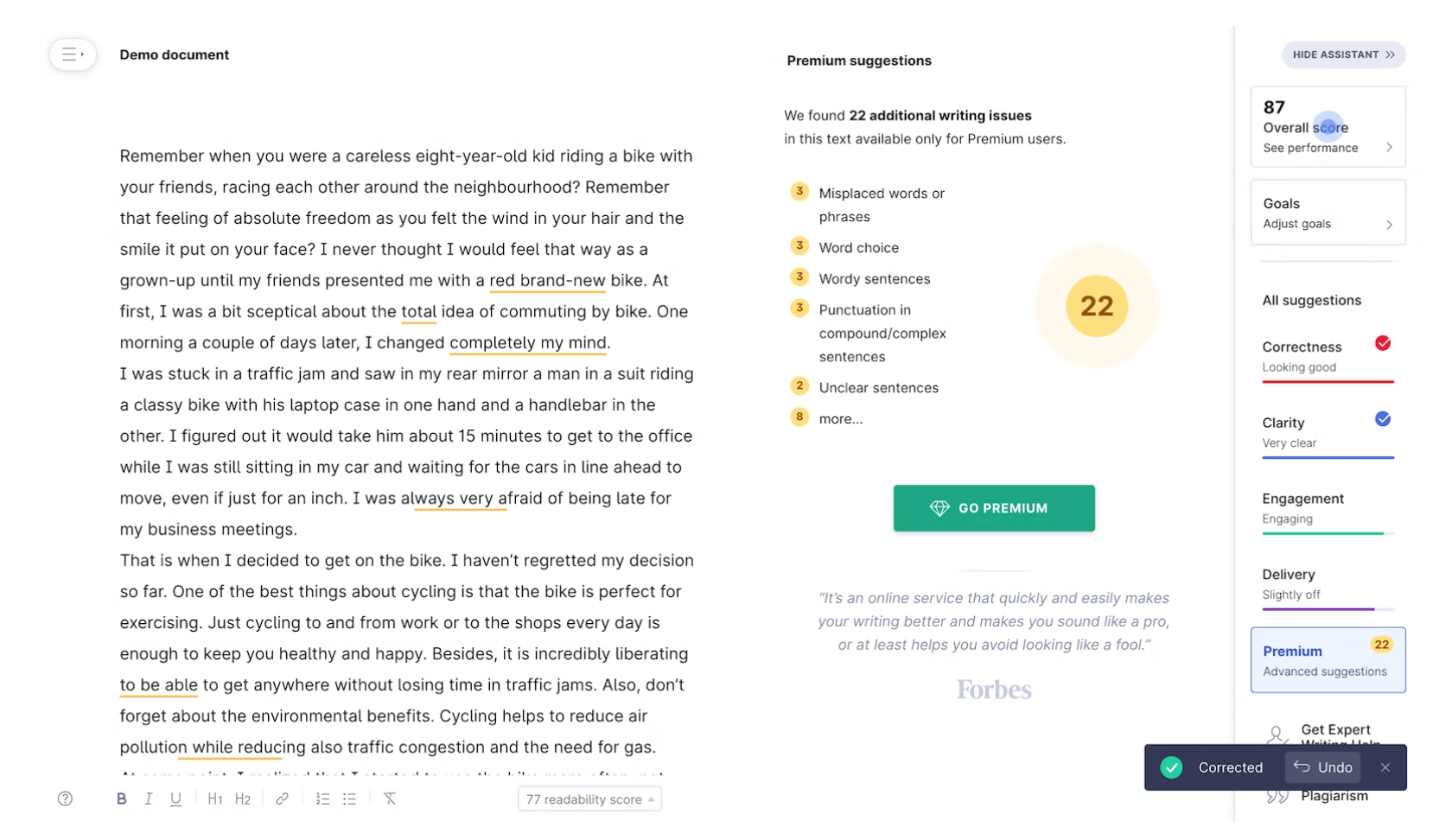

Freemium pricing

Offer a basic, limited version of a product completely free. Charge a premium or supplementary fee for full access or additional features. This is the de facto standard model used by 74% of SaaS vendors.

This way, the company has a chance to build brand awareness without the need for expensive marketing campaigns. But it entails high operational costs, as the company needs to actively upsell to generate revenue. Thus, this strategy requires a huge volume for good ROI. Grammarly is a great example of what a freemium pricing model looks like.

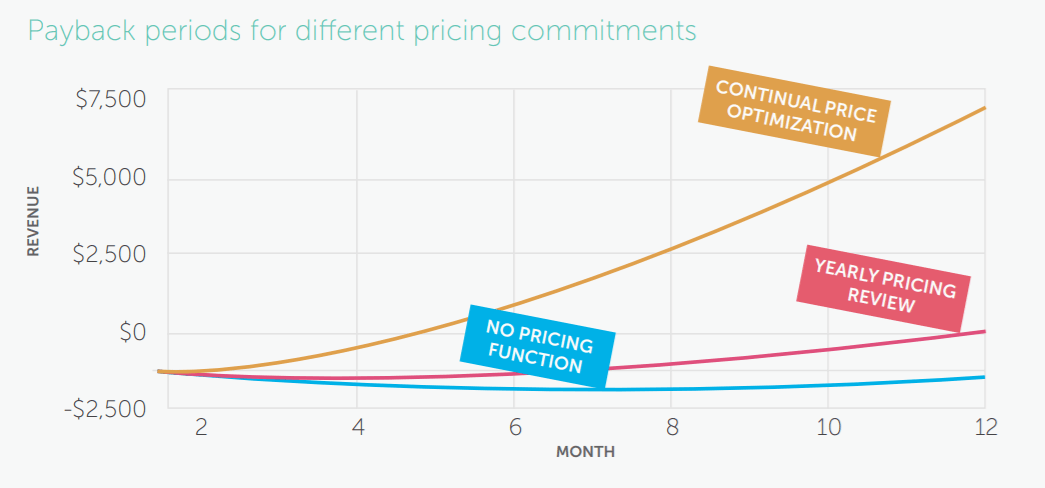

PriceIntelligently’s Anatomy of SaaS Pricing Strategy recommends SaaS companies to focus on continuous price optimization. It is not sufficient to examine the pricing model once a quarter or year; the organization must constantly experiment with pricing methods and assess the outcomes.

Source: priceintelligently.com

#9 Survive the launch

Bringing a SaaS product to market requires coordination between product, marketing, sales, and customer success. A cohesive go-to-market approach ensures that the product launches to the right audience, with clear communication about value and an onboarding experience that drives early success.

- Defining target customer segments and ICPs.

- Creating clear messaging tied to validated outcomes.

- Planning education, onboarding, and support resources.

- Tracking performance metrics against business goals.

The main goal here is to get your product into the hands of as many target customers as possible to collect valuable feedback.

#10 Let feedback guide your SaaS product development

In SaaS product development, ideas must always be connected to measurable outcomes. Rather than tracking an abstract list of metrics, it is useful to adopt a core set of SaaS indicators that correlate with product success and business health. Commonly tracked indicators include:

- Monthly Recurring Revenue (MRR) tracks recurring income trends over time.

- Annual Recurring Revenue (MRR) is a similar metric favored by B2B products with longer billing cycles.

- Churn Rate measures the rate at which customers leave.

- Customer Activation counts how many users complete the steps that lead to value realization.

- Customer Acquisition Cost (CAC) counts all sales and marketing expenses needed to bring in a single customer.

- CAC Payback shows how long it takes to recover CAC from the revenue generated by the customer.

- Monthly Burn Rate tells how much a SaaS company is spending each month to cover operating costs, product development, marketing, and other expenses.

- Net Revenue Retention (NRR) measures how much recurring revenue is retained from existing customers over a period (including expansion, upsells, and downgrades), after accounting for churn.

- Gross Revenue Retention Rate (GRR) shows the portion of MRR/ARR retained from existing customers, excluding any upsells or expansion.

- Customer Lifetime Value (LTV) tracks the revenue a customer generates over their lifetime with your product.

- Net Revenue Retention (NRR) measures the amount of ARR from existing users over 12 months.

- SaaS Magic Number quantifies how efficiently a company turns sales and marketing spend into value by comparing the increase in revenue over a period to the sales & marketing costs in the prior period.

These metrics give you early insight into whether your product is resonating, where engagement is strong or weak, and how customer behavior changes over time. But how do you know that you’re doing well? Specific numbers differ greatly by industry and vertical niche, pricing model, and maturity/AAR.

However, according to the Rule of 40, a thriving SaaS product should have a Revenue Growth Rate (%) + Profit Margin (%) that is equal to 40% or greater. Here are a few more benchmarks from the 2025 SaaS Benchmarks Report:

| Metric | 25th percentile | Median | 75th percentile |

| Growth Rate (YoY) | |||

| <$1M ARR | 29% | 100% | 300% |

| $1-5M ARR | 24% | 50% | 100% |

| $5-20M ARR | 15% | 31% | 72% |

| $20-50M ARR | 16% | 30% | 41% |

| >$50M ARR | 10% | 16% | 29% |

| Gross Revenue Retention Rate | 80% | 91% | 95% |

| Net Revenue Retention Rate | 78% | 102% | 115% |

| Monthly Burn Rate | |||

| <$1M ARR | $50K | $50K | $175K |

| $1-5M ARR | $38K | $175K | $375K |

| $5-20M ARR | $0 | $175K | $625K |

| $20-50M ARR | $50K | $50K | $625K |

| >$50M ARR | $0 | $0 | $375K |

| Software Gross Margin | 65% | 77% | 84% |

| Rule of 40 | |||

| <$1M ARR | 25% | 46% | 98% |

| $1-5M ARR | 10% | 33% | 80% |

| $5-20M ARR | -3% | 20% | 35% |

| $20-50M ARR | 11% | 24% | 41% |

| >$50M ARR | 15% | 30% | 38% |

| CAC Payback (months) | |||

| <$1M ARR | 2 | 5 | 8 |

| $1-5M ARR | 5 | 8 | 14 |

| $5-20M ARR | 8 | 14 | 22 |

| $20-50M ARR | 11 | 20 | 27 |

| >$50M ARR | 13 | 17 | 22 |

| ARR per Employee | |||

| <$1M ARR | $41K | $55K | $100K |

| $1-5M ARR | $85K | $136K | $200K |

| $5-20M ARR | $115K | $167K | $220K |

| $20-50M ARR | $157K | $268K | $350K |

| >$50M ARR | $123K | $278K | $397K |

| SaaS Magic Number | .50 | .94 | 2.0 |

| Blended CAC Ratio | $1.17 | $1.40 | $1.84 |

Up until now, you have developed a SaaS product based on what you thought was important. Now you have a much better path to follow: real data from real customers using (or not using) the product.

With that in mind, reopen your product backlog, update it if necessary by adding the features it lacks or removing features, and plan the following iterations, taking into account the feedback received. The product can only be complete when iterations no longer produce enough marginal value to justify SaaS product development.

Source: roadmunk.com

Another important metric for SaaS product development is subscription revenues. Following and analyzing this data will aid in identifying areas for improvement, features that need to be improved, added, or removed, and sales techniques that need to be changed.

Start SaaS product development with MindK

The SaaS industry is still on the rise. However, entering the market is not always straightforward and requires a profound understanding of how the sector operates. But we hope that these SaaS product development tips will assist in your journey.

The MindK team is always willing to share the knowledge and experience in developing SaaS products, as well as help you through this process. Our services include end-to-end product strategy and development for startups as well as SaaS modernization for established brands. To start a conversation, just share your contact details, and our SaaS developers will get back to you within 24 hours.